Business

Greater than 8 in 10 small enterprise house owners fearful og Autumn Price range bulletins that might injury their progress plans

Nationally, 86% of UK small enterprise house owners are scared of Autumn Price range bulletins that might negatively affect the expansion outlook and funds of their enterprises – in accordance with new analysis from Novuna Enterprise Finance.

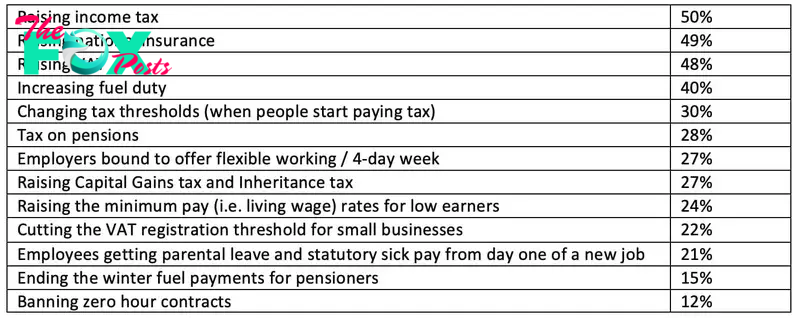

For people who expressed considerations, the prospect of nationwide insurance coverage hikes (49%), rises to VAT (48%) and revenue tax (50%) had been points small enterprise house owners believed would injury enterprise progress. Versatile working was main a priority in lots of conventional sectors, whist the property sector feared the ripple-effect from the market if there have been rises to Capital Beneficial properties tax or Inheritance tax.

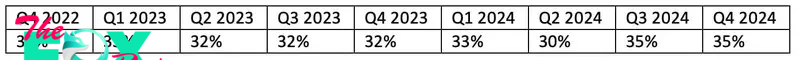

The findings come at a time when there was an increase in the share of UK small enterprise predicting progress, rising from 30% to 35% within the weeks instantly after the Common Election. This welcome upturn in small enterprise confidence represented a two-year excessive, following a interval of falling after which flat enterprise confidence throughout cost-of-living disaster.

Of concern this month, 78% of these small companies predicting important enlargement for subsequent three months to December 2024 are additionally enterprises that specific concern on how the Autumn Price range may adversely affect their progress plans.

The nationally consultant ballot requested 1,046 small enterprise house owners which, if any, of quite a few potential Price range bulletins would negatively affect the expansion outlook and funds of their enterprise, if the brand new authorities was to use them within the Autumn Price range. Issues over the Autumn Price range had been comparatively even throughout all business sectors – a minimum of 81% of enterprise house owners in each business sector cited attainable Price range insurance policies that might negatively affect the expansion outlook and funds of their enterprise.

The particular points cited assorted by business sector:

· The wide-ranging market hypothesis on potential rises to nationwide insurance coverage brought about most concern for small companies in manufacturing (61%), transport and distribution (61%) and development (56%).

· Issues over the prospect of rises to revenue tax had been strongly felt within the retail (56%) and property sectors (56%) – sectors the place enterprise house owners are conscious about the necessity to keep shopper confidence and spending energy.

· Small enterprise house owners in transport and distribution (68%) and development (63%) had been most fearful concerning the affect of any rises to gas obligation.

· Modifications to working patterns and pay additionally was a explanation for concern. Small companies in manufacturing (44%) and the transport and distribution sector (44%) cited that forcing employers to supply versatile working would negatively affect the expansion outlook and funds of their enterprise. Additional, small companies within the hospitality (42%) and manufacturing sectors additionally expressed concern concerning the affect to enterprise stability of elevating the minimal pay charges for low earners. Nationally, 21% of small companies had been involved concerning the affect to their enterprise’s stability of workers getting parental depart and statutory sick pay from day considered one of a brand new job.

· Small companies within the property sector had been most involved about the potential for rises to Capital Beneficial properties tax and Inheritance tax (48%) when it comes to the knock on impact for his or her enterprises.

Joanna Morris, Head of Perception at Novuna Enterprise Finance commented: “While nearly day by day there appears to be hypothesis over what might be introduced within the Autumn Price range, in reality nobody really is aware of at this second in time. What our survey does reveal, nevertheless, is how hard-fought however frail the unturn in small enterprise confidence has been because the Common Election. After two-years of small enterprise confidence not transferring every quarter, the upturn in July was welcome information for the financial system and coincided with inflation falling and experiences of modest progress to the UK financial system in August.

“All this makes the timing of the Autumn Price range necessary. Small companies need help to energy their progress plans ahead – it’s a essential time to construct on the indicators of upturn since July – however fiscal modifications that add to the price burden of UK small companies, enhance crimson tape or dampen shopper spending confidence may see set off a fall in small enterprise progress outlook for the ultimate months of 2024 and going into 2025.”

For extra data, contact elephant communications

Man Bellamy – 07766 775216 / [email protected]

George Visitor – 07908 551589 / [email protected]

Further tables

Potential Autumn Price range initiatives that might negatively affect small enterprise progress outlook and funds

Share of small companies predicting progress every quarter – outcomes over time

-

Business8h ago

Business8h agoUS House passes measure that could punish nonprofits Treasury Department decides are ‘terrorist’

-

Business8h ago

Business8h agoFast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers

-

Business1d ago

Business1d agoNew Information: These HV Big Lots Are Now Staying Open

-

Business1d ago

Business1d agoBrush Fire Rages On Near Butternut In Great Barrington, MA

-

Business1d ago

Business1d agoU.S. Antitrust Regulators Seek to Break Up Google, Force Sale of Chrome Browser

-

Business1d ago

Business1d agoSuccessful White Men Alone Can’t Create America’s Economic Future

-

Business2d ago

Business2d agoThe Rise of Silent Services

-

Business2d ago

Business2d agoTim Latimer