Cryptocurrency

DigiFT Introduces First RWA Depository Receipt Tokens to Safeguard Investors’ Rights And Protection On-chain

[PRESS RELEASE – Singapore, Singapore, March 25th, 2024]

DigiFT, the first licensed exchange for on-chain real-world assets, announced the launch of the first-ever U.S. Treasury Bill depository receipt tokens that represent direct beneficial ownership in the underlying U.S. Treasury Bill.

Depositary receipts (DR) are a well-tested structure in traditional finance and was first introduced in the late 1920s when J.P. Morgan created the first American Depositary Receipt (ADR) to facilitate trading of the shares of British retailer Selfridges on the New York Stock Exchange (NYSE). The 1990s saw further expansion in the use of depository receipts, including the introduction of Global Depositary Receipts (GDRs) by international banks for investors outside the United States.

By deploying the DR structure on-chain, DigiFT is proud to have pioneered a token issuance model that addresses a critical market challenge with Real World Asset (RWA) tokenization: the absence of a robust legal framework that enables “tokens” to accurately and, importantly legally, represent the direct beneficial interest of token holders in the underlying asset while facilitating settlement on-chain.

Presently, the majority of RWA tokens in circulation are wrapped tokens that represent interest in a special purpose vehicle, feeder fund or derivative instrument which holds or mirror the underlying assets. These wrapped tokens are often structured in complex legal arrangements, making it challenging for investors to fully comprehend the legal implications. Token holders have limited or no direct beneficial claim on the assets they are investing into. In contrast, Tokens issued under DigiFT’s DR structure offer a much more straightforward legal framework, making it easier for investors to understand. The tokens represent a fractional beneficial interest in the underlying capital market securities, allowing investors to legally lay claim to and directly benefit from the economic returns generated by the underlying assets.

As the first RWA exchange on the public blockchain to be licensed by a Tier-1 financial regulator, DigiFT combines deep financial and deep technological expertise to offer regulated financial solutions on-chain. The DigiFT U.S. Treasury Tokens (DRUST) is the first offering of a series, under the DR structure. Each DRUST is directly backed by AA+ rated, highly liquid and short-term U.S. Treasury Bills, tailor-made for stablecoin issuers and Web3 product developer / managers seeking regulatory compliant treasury as well as cash management solutions. Institutional and accredited investors can access DRUST from their authorised self-custodial wallets using fiat or stablecoins anytime anywhere.

Henry Zhang, Founder and CEO of DigiFT said, “DigiFT’s innovative DR structure addresses a pain point in the current RWA market, empowering investors with direct ownership of underlying assets and returns. Looking ahead, DigiFT remains committed to expanding the universe of traditional financial assets in the Web3 space through the DR model, offering better investor protection and transparency.”

Disclaimer: This article is not an advertisement making an offer or calling attention to an offer or intended offer

About DigiFT

DigiFT is the first regulated exchange for on-chain real-world assets, approved as a Recognised Market Operator with a Capital Markets Services license by the Monetary Authority of Singapore. DigiFT allows asset owners to issue blockchain-based security tokens and investors can trade with continuous liquidity via an Automated Market Maker (AMM).

Established in Singapore in 2021, DigiFT is fully committed to meeting regulatory requirements to operate in the capital markets space in Singapore, while providing innovative financial solutions that push the boundaries of financial services in a responsible manner.

DigiFT’s founding team comprises executives who have held positions within the finance and fintech worlds at Citi, Standard Chartered, Morgan Stanley, Shenzhen Stock Exchange and possess deep blockchain Technology knowledge, having successfully developed digital asset exchange and products in the past.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

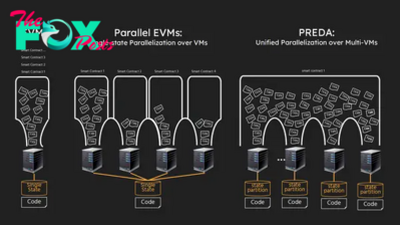

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network