Cryptocurrency

Which Comes First for Polkadot? (DOT Price Analysis)

Polkadot’s recent price action has been characterized by subdued movement and minimal volatility following a swift decline toward the $6 level. However, the Cryptocurrency finds itself at a crucial juncture, with a potential breakout poised to determine its next direction.

Polkadot Price Analysis: Technicals

By Shayan

The Daily Chart

A thorough analysis of the daily chart reveals a period of consolidation around the $6 mark, marked by low volatility and indecision in the market. This suggests a looming battle between buyers and sellers, hinting at an impending significant movement.

Despite this uncertainty, the Polkadot price is currently supported by a strong and decisive range, anchored by the significant 200-day moving average at $6.93 and the critical support level of the 0.618 Fibonacci level ($6.7). This robust support zone is bolstered by substantial demand and has the potential to thwart further downward pressure, potentially propelling the price toward the significant resistance zone around $9.

The 4-Hour Chart

A detailed examination of the 4-hour timeframe reveals a rapid descent toward the $6 level, where the price encountered significant demand, leading to a slight reversal. However, the subsequent sideways consolidation phase has seen minimal volatility and a lack of decisive momentum.

Nevertheless, the price has formed a sideways triangle pattern, with a breakout above its upper boundary indicating a continuation of the bullish trend.

Currently, DOT teeters on the brink of breaking above this triangle pattern. If it happens, Polkadot is expected to sustain its upward trajectory, with potential targets lying within the price range defined by the 0.5 ($7.4) and 0.618 ($7.8) Fibonacci levels.

Conversely, a break below the lower boundary of the triangle pattern could signal a continuation of the bearish retracement toward the $6 level.

Sentiment Analysis

By Shayan

The significant impact of the perPetual futures market on Polkadot’s price dynamics cannot be overstated. Many short-term price movements, particularly those following periods of consolidation, are driven by liquidations within the futures market. Therefore, understanding where liquidity is most concentrated can offer valuable insights.

The Binance DOT/USDT liquidation heatmap provides a visual representation of price levels where large-scale liquidation events are likely to occur. Those highlighted in yellow on the chart signal the potential for a cascade of liquidations.

As illustrated in the chart, the $7 and $6 price zones are characterized by substantial liquidity. Consequently, if the price embarks on an upward surge toward the $7 threshold, it may trigger a significant liquidation cascade, resulting in heightened volatility and a notable short-term decline. Conversely, should the market retreat towards the $6 level, a rapid surge could ensue due to a cascade of long liquidations, leading to an immediate rebound.

These levels serve as crucial reference points in the short term and have the potential to shape the market trend in the weeks ahead.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

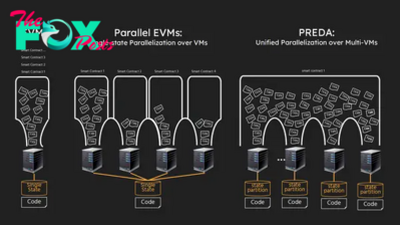

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network