Cryptocurrency

When Will Bitcoin’s Correction End? Bulls Unsuccessful at Pushing $68K (Bitcoin Price Analysis)

Following a remarkable surge that propelled Bitcoin to an all-time high of $73K, the price encountered significant selling pressure, resulting in a rejection.

However, after undergoing a period of corrective retracement, the price has found a firm foothold within a crucial support region, potentially putting a halt to the prevailing downtrend.

Technical Analysis

By Shayan

The Daily Chart

A comprehensive analysis of the daily chart reveals that Bitcoin’s impressive rally led to the breach of a significant resistance zone marked by its previous all-time high of $70K, ultimately reaching a new peak at $73K. However, intensified selling pressure emerged, likely as participants sought to capitalize on their profits.

Consequently, this heightened selling pressure halted the uptrend, triggering a notable 12.5% decline. Despite this downturn, Bitcoin encounters multiple significant support levels along its trajectory, including the 0.382 ($64,917), 0.5 ($62,181), and 0.618 ($59,444) levels of the Fibonacci retracement.

It’s important to note that the price entering the $70K – $80K range introduces the potential for increased volatility, with profit-taking likely to exert selling pressure and possibly initiate a temporary consolidation phase.

Overall, the overarching outlook remains bullish, with Bitcoin eyeing the psychologically significant $80K price threshold.

The 4-Hour Chart

A closer examination of the 4-hour chart depicts Bitcoin’s significant rally persisting after a pullback to the upper trendline of the broken ascending channel, indicating ongoing demand in the market.

However, selling pressure emerged as the price peaked at $73K, leading to a decline. This resulted in the price repeatedly breaching previous minor swing lows; signaling continued profit realization among participants.

Moreover, a prolonged bearish divergence between the price and the RSI indicator had already indicated the potential for a temporary correction in Bitcoin’s price. Nonetheless, the price has now reached a critical support region at the upper boundary of the ascending channel, where it may find support and arrest the downtrend. However, caution is warranted, as a breach below this critical level could lead to an extended downtrend toward the $60K price range.

On-chain Analysis

By Shayan

Bitcoin’s price has been on an impressive rally recently, culminating in a new all-time high of $73K, signaling a robust bull market. This significant uptrend has presented a lucrative opportunity for market participants to capitalize on their investments, with all Bitcoin holders enjoying profitable positions.

Consequently, delving into investors’ behavior could provide valuable insights into anticipating Bitcoin’s future movements.

The chart in focus depicts the Short-Term Holder Spent Output Profit Ratio (SOPR), which quantifies the ratio of profits (or losses) realized by short-term investors (holding period below 155 days) when they sell their Bitcoin. An SOPR value exceeding one indicates an aggregate profit realization by short-term holders, while values below one suggest losses being realized.

The chart shows that the Short-Term Holder SOPR has experienced a significant surge alongside the recent price spike, reaching its peak value. This surge underscores the consistent profit realization by these holders. While this development could be perceived as a positive signal, it also raises concerns as it may introduce excess supply into the market, potentially reversing the prevailing trend or prompting a correction.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

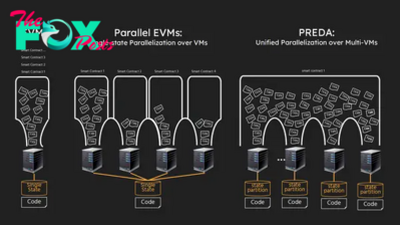

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network