Cryptocurrency

United States Dominates Global Crypto Market With Massive $9.3 Billion In Profits

In a recent report by market intelligence firm Chainalysis, it has been revealed that global crypto gains in 2023 amounted to a staggering $37.6 billion. This profit surge reflects improved asset prices and market sentiment compared to 2022.

Although this figure falls short of the $159.7 billion gains witnessed during the 2021 bull market, it signifies a significant recovery from the estimated losses of $127.1 billion experienced in 2022.

Sharp Surge In Crypto Gains

The report suggests that despite similar growth rates in crypto asset prices in 2021 and 2023, the total gains for the latter year were lower. According to Chainalysis, this discrepancy could potentially be attributed to investors’ decreased inclination to convert their crypto assets into cash.

The analysis further suggests that investors in 2023 seem to have anticipated further price increases, as crypto asset prices did not exceed previous all-time highs (ATHs) during the year, unlike in 2021.

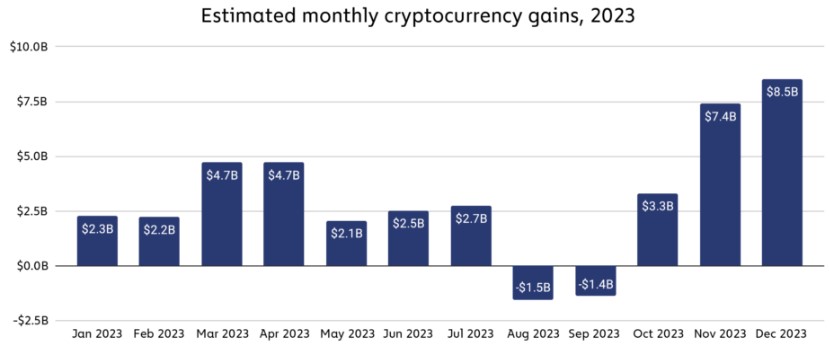

Cryptocurrency gains remained relatively consistent throughout 2023, except for two consecutive months of losses in August and September, as seen in the image above. However, gains surged sharply thereafter, with November and December eclipsing all previous months.

United States Leads

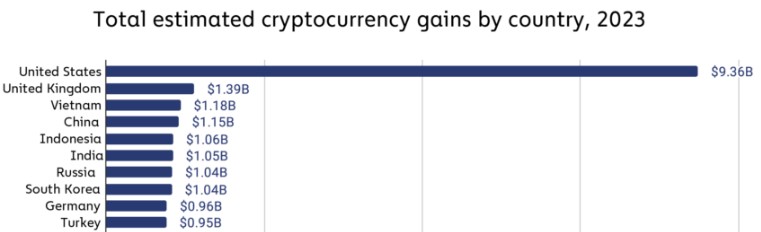

Leading the pack in Cryptocurrency gains was the United States, with an estimated $9.36 billion in profits in 2023. The United Kingdom secured the second position with an estimated $1.39 billion in crypto gains.

Notably, several upper and lower-middle-income countries, particularly in Asia, such as Vietnam, China, Indonesia, and India, achieved significant gains, each surpassing $1 billion and ranking within the top six countries worldwide.

Chainalysis had previously observed strong Cryptocurrency adoption in these income categories, particularly in “lower-middle-income” countries, which demonstrated resilience even during the recent bear market. The gains estimates indicate that investors in these countries have reaped substantial benefits from embracing the asset class.

Ultimately, the Chainalysis report suggests that the positive trends observed in 2023 have carried over into 2024, with prominent cryptocurrencies such as Bitcoin (BTC) hitting all-time highs of $73,700 following the approval of Bitcoin exchange-traded funds (ETFs) and increased institutional adoption.

If these trends persist, the firm believes that it is conceivable that gains in 2024 will align more closely with those witnessed in 2021.

As of this writing, the total crypto market cap valuation stands at $2.5 trillion, a sharp drop of over 4% in the last 24 hours alone, and down from Thursday’s two-year high of $2.7 trillion. Bitcoin, on the other hand, is trading at $68,400 after dropping as low as $65,500 but has quickly regained its current trading price, limiting losses to 4% over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for Educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

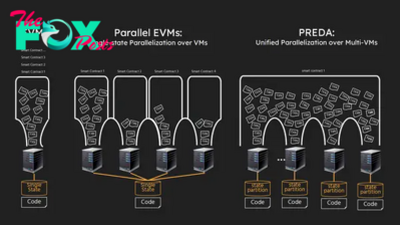

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network