Cryptocurrency

GRVT Announces Strategic Fundraise and Launches Private Beta Following Growing Market Interest

[PRESS RELEASE – Singapore, Singapore, March 19th, 2024]

- GRVT secures interest from leading trading firms and market makers, including QCP Capital, Selini Capital, Antelope, Pulsar, and Ampersan, to participate in the strategic round.

- GRVT is developing the first official self-custodial, centralized exchange on zkSync, aiming to be the leader in providing an institutional-quality hybrid exchange model.

- The launch of GRVT’s beta platform offers institutional investors a stake in building the future of seamless UX/UI centralized exchanges (CEX) with the security of autonomous on-chain settlement and self custody.

Today, GRVT, the innovative hybrid Cryptocurrency centralized exchange (CEX), is excited to announce a strategic fundraise of $2.2 million, bringing the total raised to $9.3 million. This iNFLux of capital, driven by growing interest from both institutional and retail investors, aligns with the launch of GRVT’s private beta platform. Notably, major trading firms and market makers such as QCP Capital, Selini Capital, Antelope, Pulsar Trading, and Ampersan have contributed to this latest funding round. They join a roster of industry-leading partners and investors, including Delphi Ventures, Matrix Partners, Hack VC, and ABCDE Capital, reinforcing GRVT’s position in the market. Additionally, GRVT has successfully attracted over 12 major market makers for its options and perPetual offerings, showcasing the platform’s expanding iNFLuence and appeal in the Cryptocurrency trading space.

Driving Innovation in Crypto Trading

As a pioneering self-custodial CEX, GRVT is invested by Matter Labs, the creator of zkSync. The company is building the first official Appchain on the ecosystem, garnering significant retail market interest before its open beta launch. More than 2 million retail users have signed up for the waitlist, largely drawn by the first phase of the platform’s rewards campaign–the zkSync Mystery Box.

With the growing interest and demand for crypto derivatives among both retail and institutional investors globally, traders are consistently encountering challenges related to execution and security stemming from exchange risk. These concerns include everything from scams and phishing attacks to regulatory issues.

“The last crypto crisis showed us that relying on purely centralized exchange models that are built on trust can pose significant risks. We aim to solve the issues of counterparty risk by using the blockchain for settlements while maintaining the reliability and throughput of CeFi exchanges,” said Hong Yea, GRVT’s Co-founder and CEO. “We believe a hybrid concept is the way forward to build a safer exchange, and for further blockchain adoption as the crypto markets mature.”

GRVT’s Platform Features

GRVT’s goal is to become one of the first companies to offer an institutional-grade hybrid exchange model. The platform will feature a central limit order book for perPetuals and options trading, along with request for quote (RFQ) and spot trading later this year. It also provides efficient margin models, including portfolio and cross margining.

By separating exchange and custody functions, GRVT enables users to have full custody of their assets. This will be achieved through mixing off-chain order matchings and on-chain settlements, boasting a speed of 600,000 transactions per second (TPS) with a single-digit millisecond latency. For institutional investors, the platform provides co-location services to execute faster trading for larger orders.

To effectively eliminate counterparty risk, GRVT utilizes smart contracts while maintaining the same onboarding flow, liquidity, and trading efficiency found on CEXs. The platform also incorporates zero-knowledge proofs and Validium Technology to ensure on-chain privacy by keeping trade and margin details away from public eyes, high throughput, low latency and gasless trading. Details on users’ trades and margins are never revealed to the public.

“QCP Capital is thrilled to support GRVT as they build a new model for crypto exchanges, merging the efficiency of CeFi with the security of DeFi. We believe GRVT’s focus on self-custody and on-chain settlements will significantly improve the crypto exchange experience, offering users enhanced security and reliability,” said Darius Sit, Founder and CIO of QCP Capital.

User Security & Protection Services

For enhanced safety, GRVT’s multi-layered security architecture integrates robust controls from web2 and web3. It incorporates features such as password login, two-factor authentication, wallet registration, private keys, and whitelisting wallets.

Unlike many centralized and decentralized exchanges, GRVT distinguishes itself by implementing rigorous screening protocols of clients, including KYC and AML procedures. It works closely with auditing and pentesting partners, such as Spearbit DAO and NCC Group. The firm is also currently applying for a license in Bermuda, with plans to secure permits in the Middle East and Europe.

GRVT’s Beta Testnet

GRVT’s private beta will begin on Tuesday, March 19, 2024 with a select group of industry iNFLuencer partners. The stage will gradually open up to additional groups of testers invited from the community, leading up to the launch of the official mainnet slated for the second half of this year.

For more information and to sign up for GRVT’s waitlist, please visit https://grvt.io/.

About GRVT

Founded in 2022 and based in Singapore, GRVT is a self-custodial cryptocurrency hybrid exchange. Invested by Matter Labs, the creator of zkSync, the company is building the ecosystem’s first official hyperchain. GRVT aims to eliminate counterparty risk by combining traditional trading infrastructure with blockchain smart contract settlement, using zero-knowledge proofs and Validium technology. The platform blends off-chain order matchings and on-chain settlements, achieving a speed of 600,000 transactions per second with a single-digit millisecond latency. GRVT will debut with central limit order book trading for perpetuals and options, with future plans for request-for-quote (RFQ) and spot trading.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

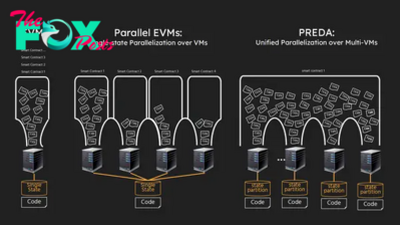

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network