Cryptocurrency

Coinbase Claps Back at Senators Urging Halt on Crypto ETF Approvals

Paul Grewal, the Chief Legal Officer at CoiNBAse, has come forward to criticize a letter written by two U.S. senators urging the Securities and Exchange Commission (SEC) to impose stricter regulations on Bitcoin exchange-traded funds and refrain from approving any further Cryptocurrency ETF applications.

In a March 15 X thread, he challenges the assertions of senators Jack Reed and Laphonza Butler and defends the necessity of expanding the ETF market to include assets beyond Bitcoin.

Grewal Advocates for Ethereum ETFs

“Respectfully, Senators, the evidence points exactly the opposite way,” he stated.

Respectfully Senators, the evidence points exactly the opposite way. We have discussed our analysis with SEC staff and would be happy to do the same for you and any other policy makers who have questions. 1/7 https://t.co/juFj4QyDnj

— paulgrewal.eth (@iampaulgrewal) March 15, 2024

Grewal highlighted the robustness of various digital asset commodities beyond Bitcoin, citing Ethereum (ETH) as an example, stating its market liquidity and metrics rival even those of major S&P 500 stocks.

He stressed that Ethereum exhibits precisely the same level of strong and consistent correlation, which is suitable for enabling market surveillance when compared to Bitcoin, both in its future and spot markets.

The CoiNBAse executive also referenced a recent comment letter submitted to the SEC, providing legal, technical, and economic rationale for the approval of an Ethereum Exchange-Traded Product (ETP).

The Senator’s Letter

In their March 11 letter, Democratic senators Jack Reed and Laphonza Butler argued against further approvals of crypto ETFs by the SEC, warning of the risks posed to investors by thinly traded markets susceptible to fraud and manipulation.

“Retail investors would face enormous risks from ETPs referencing thinly traded cryptocurrencies or cryptocurrencies whose prices are especially susceptible to pump-and-dump or other fraudulent schemes,” read the letter.

The senators emphasized the need for caution, urging the SEC to refrain from allowing recent approvals of spot Bitcoin ETFs to set a precedent for future ones, citing BTC’s relatively established and scrutinized market compared to other cryptocurrencies.

🚨NEW: Rhode Island Senator @SenJackReed and California Senator @Senlaphonza have penned a letter to @GaryGensler asking for the agency to step in to ensure broker-dealers are giving investors the proper disclosures around the $BTC ETFs (which they say should be properly referred… pic.twitter.com/xwlfu7kx3F

— Eleanor Terrett (@EleanorTerrett) March 14, 2024

Reed and Butler also called for enhanced regulatory scrutiny on spot Bitcoin ETF products, urging for specific steps to be taken to safeguard investor interests, including increased oversight of brokers and advisors.

They expressed doubt regarding the suitability of other cryptocurrencies to support associated ETPs, citing insufficient trading volumes and market integrity. They also questioned the likelihood of futures markets for other cryptocurrencies exhibiting the necessary correlation with spot markets to facilitate effective market surveillance for identifying and preventing bad actors.

Presently, the SEC is reviewing eight proposed applications for spot Ethereum ETFs, with expectations that other altcoins may follow suit in the future.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

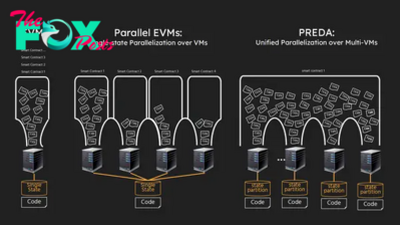

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network