Cryptocurrency

Bitcoin To $53,200? Why History Says It’s Possible

As Bitcoin drops below $68,000, History suggests this correction is rather tame for bull markets, as plunges to this deep on-chain level have been the norm.

Bitcoin Short-Term Holder Realized Price Is Currently Around $53,200

As pointed out by CryptoQuant Netherlands community manager Maartunn in a post on X, BTC still has a decent margin over the realized price of the short-term holders.

The “realized price” is an on-chain metric that keeps track of the average price at which the Bitcoin investors acquired their coins. The indicator calculates this value by going through the transaction History of each coin and assuming that the last transfer of it was the last time it was purchased (that is, the price at the time is its current cost basis).

When the spot value of the Cryptocurrency dips below the realized price, it means that the average investor is now in a state of loss. On the other hand, a break above implies the market as a whole has entered into net profits.

In the context of the current discussion, the realized price for only a particular segment of the investors is of interest: the “short-term holders” (STHs). The STHs include all the investors who bought their coins within the past 155 days.

Now, here is a chart that shows the trend in the Bitcoin realized price specifically for this cohort:

Looks like the value of the metric has been trending up recently | Source: @JA_Maartun on X

As displayed in the above graph, the Bitcoin STH realized price has shot up recently as the price of the asset has gone up. This makes sense, as this group includes the most recent buyers, who would continuously be buying at higher prices in an uptrend, thus raising their average cost basis.

At present, this cohort’s realized price is about $53,200. During the past day, BTC has seen a sharp drop that has taken its price below the $68,000 mark, but clearly, the STHs would still be in high profits even after this drawdown.

“In previous bull markets, the average cost basis of short-term holders was fully reset multiple times,” explains Maartunn. This trend is most prominent in the data for the 2017 bull run when the price retested this level several times.

An interesting pattern that has been held is that these retests of the level during bull trends have generally resulted in the Cryptocurrency finding support and turning itself back around.

The explanation for this trend may lie in the fickle nature of the STHs. The cost basis is an important level for these investors, and when a retest of it happens, they panic and show some reaction.

During uptrends, these holders are more likely to buy more when a retest of their cost basis occurs since they may think that the same price levels that were profitable earlier will be so again in the near future.

Naturally, it’s not a certainty that Bitcoin would also end up retesting this level in this bull market. Still, a correction might reach close to it if the historical precedent is anything to go by.

BTC Price

Following its 7% drop in the past day, Bitcoin is trading at around $67,700.

The price of the coin has registered a sharp drop over the last 24 hours | Source: BTCUSD on TradingView

Featured image from Maxim Hopman on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is provided for Educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

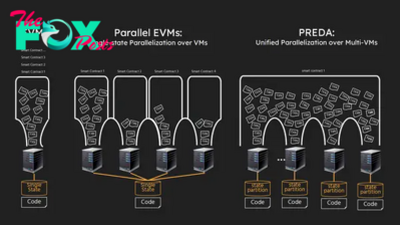

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network