Cryptocurrency

US Senators Introduce Stablecoin Regulatory Framework, While Warren Wants Restrictions

On April 17, the two pro-crypto Senators introduced the Lummis-Gillibrand Payment Stablecoin Act.

The bill “solves key policy challenges that have lingered around previous proposals and provides prudential regulation and added consumer protections to stablecoin issuers,” said Lummis, who added, “But above all, it allows innovation to prosper.”

The Senators have been drafting the bill for months as customer protections and proper custody practices for issuers came into focus following the fallout of the FTX collapse.

🚨@gillibrandny and I are introducing the most comprehensive stablecoin bill to date.

Crypto assets are revolutionizing the world and as the undisputed leader in financial innovation, the U.S. must embrace crypto assets, but it cannot be done without clear rules for stablecoins. pic.twitter.com/vwRUEBUdsl

— Senator Cynthia Lummis (@SenLummis) April 17, 2024

Stablecoin Regulations a Step Closer

The bill authorizes state non-depository trust companies to issue payment stablecoins up to $10 billion, explained Senator Lummis.

She added that the bipartisan legislation maintains the dual banking system “that is critical to preserving the parity enjoyed by the state and federal financial institutions and establishes guardrails for existing issuers.”

In essence, the legislation protects consumers by requiring stablecoin issuers to maintain 1:1 reserves and prohibiting uNBAcked, algorithmic stablecoins. Additionally, it aims to prevent illicit or unauthorized use of stablecoins by issuers and users.

In addition to the stablecoin framework, Senators Lummis and Gillibrand are also co-authors of the Responsible Financial Innovation Act, legislation that would create a comprehensive regulatory framework for crypto assets.

This bill also aims to clarify the roles of the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) in regulating digital assets, favoring the latter as digital assets have not been designated as securities.

I’m proud to join @SenLummis to introduce the Payment Stablecoin Act.

Passing a regulatory framework for stablecoins is critical to protecting consumers, promoting responsible innovation, and cracking down on money laundering and illicit finance. https://t.co/UP9pk0uQkt pic.twitter.com/lIqA3rwQXN

— Sen. Kirsten Gillibrand (@gillibrandny) April 17, 2024

Senator Warren Waves The Red Flag

Meanwhile, United States Senator Elizabeth Warren sent a letter to Treasury Secretary Janet Yellen this week regarding tighter controls for stablecoins.

Warren expressed support for legislative adoption of more comprehensive anti-money laundering and counter-terrorism financing measures for stablecoins but did not directly reference the Lummis-Gillibrand bill.

“Those authorities must be adopted into any legislation Congress advances to create a new regulatory framework around the $157 billion stablecoin market,” she said before reiterating her anti-crypto rhetoric.

“Folding stablecoins deeper into the banking system will supercharge trading in the crypto market, exploding the opportunities for terrorists and other bad actors to exploit those financing channels to both evade sanctions and receive a limitless stream of untraceable income.”

A Digital Chamber policy associate commented that Warren conveniently left out key consumer protection and enforcement aspects of the Lummis-Gillibrand bill from her talking points.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

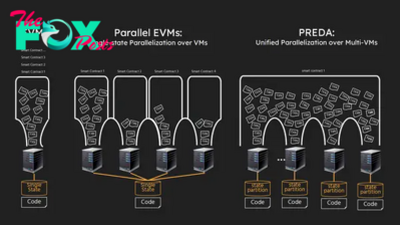

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network