History

The Tariff History Donald Trump Is Overlooking

The Harris/Walz Democratic presidential ticket has popularized the slogan “We Won’t Go Back.” The “back” they are referring to is the chaotic four years of Donald J. Trump’s first presidential administration, as well as a pre-Roe v. Wade era of unsafe abortions.

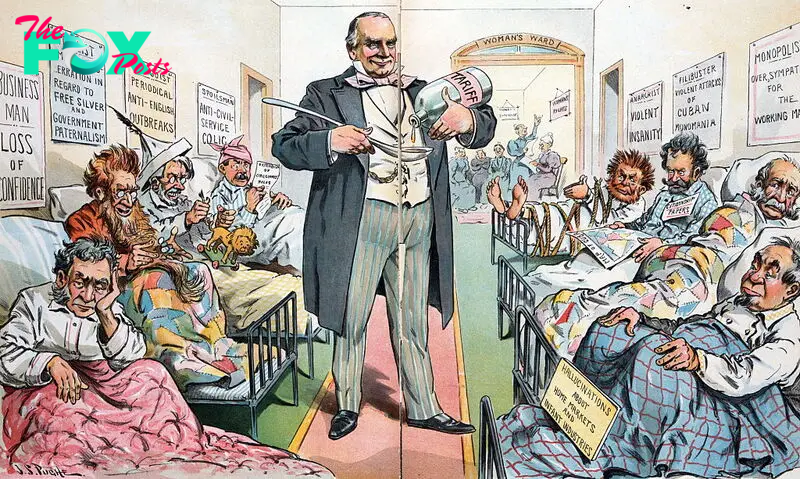

But the catchy Democratic rallying cry could just as easily apply to Trump’s economic policies, particularly his tax and international trade policies, which would take the United States back not just to Trump’s presidency but to the late 19th century—back to an era when regressive tariffs and the absence of progressive income taxes fueled the massive inequalities of the first Gilded Age.

Trump recently vowed that if he is re-elected, he will fundamentally transform the U.S. tax and trade systems. As part of his “new American industrialism,” Trump proposes to erode the United States’ existing progressive income and wealth-transfer taxes, essentially replacing them with regressive tariffs, or import duties, on consumer goods. As part of his economic nationalism, Trump has called for a 20% across-the-board tariff on all imports, a 60% duty on Chinese goods, and a punitive tax on U.S. companies that ship jobs overseas.

Trump uses his usual historical hyperbole to drive the point home. “Tariffs are the greatest thing ever invented,” he said. He has even boastfully called himself “tariff man” and has held out 19th century Republican President William McKinley’s protectionist tariffs as a model for today.

Yet what is missing in Trump’s glorification of the past is any sense of the broader historical context and the sequence of events that led to the demise of the 19th century system of regressive tariffs and the rise of progressive income taxes. Curing Americans of this historical amnesia can remind them of the hard-fought roots of our current system of progressive federal taxation—a system that not only provided the necessary revenue for a modern nation-state, but also tackled broader issues of economic justice.

Read More: Where Donald Trump and Kamala Harris Stand on China

Between the end of the Civil War and the onset of World War I, import duties were the dominant source of federal government revenue, accounting at their height for nearly 60% of annual government receipts. The early justification for the high tariffs was to protect the country’s “infant industries”—and the jobs in those industries—from foreign comPetition.

But by the dawn of the 20th century, U.S. manufacturing hardly needed protection. U.S. companies were fast outpacing global comPetitors as they flooded the world market with American-made goods. As one British journalist noted in 1901, “the most serious aspect of the American industrial invasion lies in the fact that these newcomers have acquired control of almost every new industry created during the past fifteen years.”

Such American manufacturing dominance forced many lawmakers and reformers to rethink the existing tax and trade system. In the late 1800s, Democratic opponents of the Republican Party’s high tariffs and economic nationalism stressed how protectionism was no longer shielding infant industries but was instead facilitating greater concentrations of wealth and rising inequality. The protective tariff was described as “the mother of all trusts” and the driver of corporate consolidations.

Congressman Benton McMillin (D-Tenn.), an early advocate for progressive income taxes and antitrust laws, highlighted the connections between tariffs and inequality. “While the Government has thrown up its tariff walls without,” McMillin informed lawmakers, “monopolists have joined hands within for the purpose of putting up prices and plundering the people through the devices known as trusts, pools, and combines.”

Other observers similarly contended that import duties were passed along to everyday consumers, disproportionately harming the working class—taking more from those who had less. The “essential character of our protective policy,” one expert noted, “artificially and cruelly increases the cost of clothing, of bedding, of shelter, of tools, and of a thousand necessaries of daily life.”

Many of the same American lawmakers and economic experts who supported free trade also endorsed direct and progressive taxes on incomes, inheritances, and business profits. University of Michigan political economist Henry Carter Adams, a pioneering scholar of American public finance, argued that the protective tariff was based on an outdated political and social theory. The “modern state assumes duties far beyond the primitive functions of protection,” Adams wrote in his 1898 treatise. Such a “theory of taxation may have served fairly well under conceptions of government activity held in the early part of the century,” he continued, but “it must be regarded at present as somewhat antiquated.”

Despite the growing calls for free trade and progressive taxation, the movement to supplant regressive tariffs with progressive taxes faced numerous obstacles. Reformers had to overcome a conservative U.S. Supreme Court ruling that struck down the 1894 income tax. Pointing to the immense inequalities of the time, tax activists rallied support from organized labor, agrarian associations, and free-trade advocates to pass a constitutional amendment overriding the high court.

It took nearly two decades before the hard-fought 16th Amendment was ratified in 1913, laying the legal foundation for graduated income taxes. That same year, the United States, led by Democratic President Woodrow Wilson, enacted the first peacetime income tax.

The 1913 income tax arrived just in time. The start of World War I the following year dramatically diminished international trade and hence U.S. tariff revenues. The war also provided lawmakers an opportunity to revolutionize the federal tax system by enacting highly progressive taxes on incomes, inheritances, and Business profits to fund the war effort. The war was thus a pivotal event marking the eclipse of the nineteenth-century system of regressive tariffs by the rise of progressive taxation.

Read More: It's Misguided to Say That CEOS Are Warming to Trump. Here's Why

Over the past century, our federal system of direct and progressive taxes has not only provided the badly needed revenue to support a modern nation-state, but it has also helped address broader concerns about economic justice, civic identity, and public power.

As Trump’s former and proposed policies show, this history has all but been forgotten. Of course, the Biden-Harris Administration continued some of Trump’s earlier import duties, though in more targeted ways. Trump, however, has doubled down on his pro-tariff policies, promising to make their expansion a cornerstone of his next administration. Economic experts have predicted that such policies would hinder economic growth, increase inflation, harm the working class, balloon the deficit, and likely ignite a new trade war. As a result, his policies would take us back to the first Gilded Age of wealth concentration and gross economic inequality.

Trump’s calls to replace the existing federal income tax with protective tariffs is not only impractical in the face of growing federal deficits; it is also clashes with historical reality. It is one more reason why Democrats have accurately embraced the slogan “we won’t go back.”

Ajay K. Mehrotra is professor of law and history at Northwestern University, a Research Professor at the American Bar Foundation, and the author of Making the Modern American Fiscal State: Law, Politics, and the Rise of Progressive Taxation, 1877 – 1929.

Made by History takes readers beyond the headlines with articles written and edited by professional historians. Learn more about Made by History at TIME here. Opinions expressed do not necessarily reflect the views of TIME editors.

-

History1w ago

History1w agoThe 1994 Campaign that Anticipated Trump’s Immigration Stance

-

History1w ago

History1w agoThe Kamala Harris ‘Opportunity Agenda for Black Men’ Might Be Good Politics, But History Reveals It Has Flaws

-

History2w ago

History2w agoLegacies of Slavery Across the Americas Still Shape Our Politics

-

History2w ago

History2w agoKamala Harris Is Dressing for the Presidency

-

History2w ago

History2w agoWhat Melania Trump’s Decision to Speak Out on Abortion Says About the GOP

-

History2w ago

History2w agoThe Long Global History of Ghosts

-

History2w ago

History2w agoAmerica’s Forgotten Occult Origins

-

History2w ago

History2w agoHistory Suggests That Trump’s Approach to Putin Is All Wrong