Cryptocurrency

Ripple-SEC Settlement Odds At 40% Post-Ruling

In an escalation of the ongoing legal battle between Ripple Labs and the US Securities and Exchange Commission (SEC), the regulatory agency has advanced its position by filing a Motion for Remedies and Entry of Final Judgment, which notably includes a request for a $2 billion penalty against Ripple.

Fred Rispoli, a pro-XRP lawyer and founder of HODL Law, has provided a detailed analysis of the SEC’s motion through a series of comments on X (formerly Twitter). Rispoli’s breakdown offers an insider perspective on the potential outcomes and strategies at play.

He noted, “#XRPcommunity The SEC’s motion for judgment has been publicly filed. TLDR: SEC is following the playbook I outlined two months ago,” reflecting on the predictability of the SEC’s actions but also underscoring the gravity of the situation for Ripple.

SEC Puts Ripple In Trouble

Rispoli’s analysis highlights several key points from the SEC’s filing, with particular emphasis on the claim that Ripple offered significant discounts on XRP sales to certain institutional buyers. The SEC argues that there were two groups of institutional sales investors while Ripple offered one group significant discounts in XRP price over the other group that did not receive them.

This practice, according to the SEC, not only skewed some institutional sales investors but also potentially disadvantaged retail investors. The lawyer credited the agency for this tactical move.

“It realized that it needs to show how investors were actually harmed. Ripple has already said the SEC’s motion is full of mischaracterizations. Let’s hope that is correct because the picture painted is not a good look for Ripple and lends credence to the XRP haters on why the price is so low. Namely, the deep discounts by Ripple on XRP sales,” Rispoli stated.

At the same time, he expressed concerns over these revelation, stating, “If discounts are wide enough, then Institutional Buyers (like GSR) scored unbelievable discounts and have bags-upon-bags of XRP that they could continually sell at astronomical profit,” pointing to a potential imbalance in the investment landscape fostered by Ripple’s actions.

Furthermore, Rispoli shed light on the SEC’s portrayal of Ripple’s Business practices, notably the company’s continuation of XRP sales as its primary revenue source, even after legal scrutiny intensified. He elaborates, “SEC claims the financial discovery it received by court order demonstrates this is by far and away Ripple’s primary source of revenue,” suggesting a critical view of Ripple’s dependency on these sales amidst ongoing litigation.

Meanwhile, the document also reveals that Ripple is still signing contracts with institutional buyers. Since the start of the XRP lawsuit in December 2020, the company has signed 80 contracts.

Pro-XRP Lawyer Predicts Two Possible Outcomes

The classification of Ripple’s On-Demand Liquidity (ODL) transactions represents another crucial aspect of Rispoli’s analysis. The legal determination of whether these transactions constitute unlawful sales or are permissible under law is a significant factor that could iNFLuence Ripple’s operational latitude.

“Stakes are very high here,” Rispoli asserts, adding, “we have to hope Ripple has sufficiently changed its Business practices to account for Torres’ ruling.”

The potential consequences of the SEC’s motion are profound, with Rispoli speculating on the likelihood of a settlement. He assessed, “This motion is of enormous consequence,” with two options on how this ends:

One, the amount ordered by the court is low enough and rulings on newly-structured sales favorable enough (to Ripple) that there is a final settlement after the ruling. I’m now putting this at 40% odds. More likely is this will come out favorable to Ripple on the amount of money owed but that Ripple takes hits on what is allowed going forward, meaning this is going to an appeal to the 2nd.

At press time, XRP traded at $0.63.

Featured image from Shutterstock, chart from TradingView.com

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

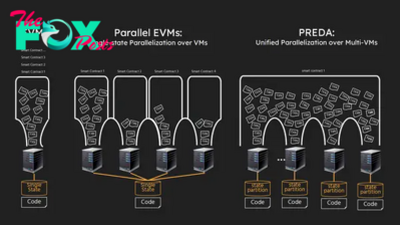

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network