Cryptocurrency

New UK Legislation To Govern Crypto Staking, Trading, By Mid-2024: What You Need To Know

The United Kingdom is poised to enact new legislation covering stablecoins and various crypto activities, including staking, trading, and custody.

The forthcoming regulations, which are expected to be implemented by June or July 2024, mark a significant milestone as they bring digital assets, such as the operation of exchanges and the custody of customer funds, under regulatory oversight for the first time.

This development follows the approval of the Financial Services and Markets Act in June 2023, which paved the way for cryptocurrencies to be treated as a regulated financial activity.

Crypto Regulation Accelerates In The UK

UK Economic Secretary Bim Afolami reaffirmed the government’s commitment to fast-tracking Cryptocurrency-related issues during the Innovate Finance Global Summit. Afolami emphasized that legislation is being developed quickly to finalize proposals for the new regulatory regime.

The government aims to complete these efforts within the next six months, allowing a range of digital asset activities under the regulatory umbrella, including the operation of exchanges and custodial services. The Economic Secretary stated:

Once it goes live, a whole host of crypto asset activities, including operating an exchange, taking custody of customers’ assets, and other things, will come within the regulatory perimeter for the first time

Moreover, the UK Financial Conduct Authority (FCA) will soon launch a consultation on an authorization regime for digital asset companies. At the same time, the government plans to establish equivalence measures for overseas firms.

The aim is to foster a regulated and supervised environment for the nascent industry, ensuring consumer protection and market integrity.

Balancing Innovation And Safeguards

As previously reported by Bitcoinist, the UK government has taken a phased approach to digital asset regulation, primarily focusing on legislation concerning fiat-backed stablecoins.

This priority is followed by addressing other areas, including algorithmic stablecoins, lending, and trading, which will be brought under the purview of conventional financial regulation.

In marked contrast to the approach and increased enforcement activity of the US Securities and Exchange Commission in the North American country, the UK government recognizes the need for greater clarity. It intends to provide a regulatory framework that balances innovation and investor protection.

However, despite the government’s efforts to create a crypto-friendly environment, the UK industry has faced challenges. Digital asset firms, including exchanges, have voiced concerns over delays and inadequate feedback from the FCA.

Recently introduced rules restricting digital asset advertising have also led to some high-profile firms scaling back or ceasing operations in the UK market. The FCA’s vigilance in tackling suspected illegal crypto promotions is evident, with over 450 warnings issued in three months in February 2024.

Nonetheless, the forthcoming legislation on stablecoins and crypto activities signifies the UK government’s commitment to fostering a regulated and supervised crypto industry.

While the specifics of the new regulations are yet to be unveiled, it is clear that crypto assets will operate within a more defined regulatory framework.

Featured image from Shutterstock, chart from TradingView.com

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

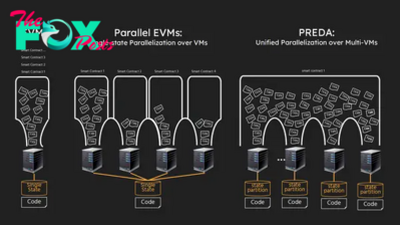

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network