Cryptocurrency

JST Digital & Stablecoin Standard Partner on Creation of Liquidity & Regulatory Compliance Standards for Stablecoins

[PRESS RELEASE – New York, United States, April 9th, 2024]

JST Digital (“the Company” or “JST”), a global financial services firm specializing in digital assets, today announced that it has joined the Stablecoin Standard, the industry body for stablecoin issuers globally, to help establish international standards for high-quality liquid stablecoins.

Scott Freeman, Co-Founder & Partner at JST Digital, commented on joining the Stablecoin Standard, “We believe stablecoins are one of the most promising use cases for digital assets and industry standards that are on par with the ones seen in traditional finance are needed to accelerate the adoption of this revolutionary Technology by the global financial system.”

As a leading market maker, trading, and financial services firm in the digital asset space, the team at JST Digital has extensive experience working with a variety of stablecoins across various blockchains and plans to bring that perspective to the council. The JST team believes we are still early in the global adoption of stablecoins and is excited to participate in this opportunity to expand the ecosystem.

Christian Walker, Chairman & Co-Founder of Stablecoin Standard, commented on JST Digital joining the council, “The team at JST Digital’s decades of experience trading both traditional financial & digital assets, coupled with their focus on regulatory compliance provides Stablecoin Standard with another unique and important perspective as we develop guiding principles that can be endorsed by the entire industry. We appreciate JST’s championing of a global set of industry standards, and support of our work in being the hub for stablecoin best practices globally.”

The JST Digital team has decades of financial regulatory experience they can leverage in the creation of regulatory-compliant stablecoin standards, including expertise from the former Chief Compliance Officer of the New York Federal Reserve and JST Digital’s Global Head of Regulatory Affairs & Integrity, Martin C. Grant.

Grant noted: “We maintain a constant dialogue with global regulators and industry participants to work towards sound standards and policies. From my years at the Fed, I know how important industry groups are to Regulators in helping shape fair and orderly markets.”

About Stablecoin Standard

Stablecoin standard the industry body for stablecoin issuers globally, focused on real world applications for stablecoins. We share international best practices, Business development use cases, industry led working groups, define what a high-quality liquid stablecoin should look like, and engage with policymakers domestically & internationally.

To learn more, users can visit: https://stablecoinstandard.com/

About JST Digital

JST Digital is a crypto-native financial services firm specializing in market making, quantitative trading and digital asset management. The partners of JST have all spent over twenty years in traditional financial services. They entered the crypto markets as early as 2014, when they began to make markets for one of the early blockchain projects. Leveraging that experience, JST was launched in 2018 to provide a full suite of traditional financial services to institutions in the digital asset market.

For more information about JST Digital, users can visit: https://jstdigital.io/

Stablecoin Standard Media Contact: [email protected]

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

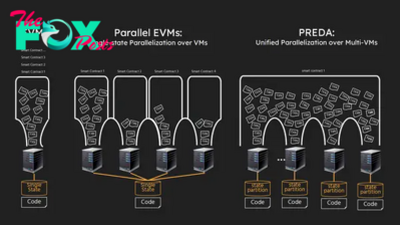

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network