Cryptocurrency

Bitcoin Volume 6.2x Less Than 2021 ATH Despite Similar Price

On-chain data shows the Bitcoin transfer volume remains significantly lower than that observed at comparable prices during the 2021 bull run peak.

Bitcoin Total Transfer Volume Has So Far Hit A High Of Just $118 Billion

As pointed out by CryptoQuant author Axel Adler Jr in a post on X, the total transfer volume of this bull run hasn’t been able to reach anywhere near the peak of the previous one.

The “total transfer volume” here refers to the total amount of Bitcoin that’s becoming involved in transactions on the network every day. The metric is measured in terms of the US Dollar (USD).

Below is the chart shared by the analyst that shows the trend in this indicator over the last couple of cycles:

The value of the metric appears to have been riding an uptrend in recent months | Source: @AxelAdlerJr on X

From the graph, it’s visible that the Bitcoin total transfer volume has been going up over the last few months. This is normal behavior for rallies, as the network tends to become more active during such periods due to an iNFLux of new users and repositioning from some of the existing holders.

The opposite is usually the case in bear markets, as extended drawdowns and long stretches of boring consolidation all result in the general investors steering clear of the Cryptocurrency.

As is apparent in the chart, the indicator’s value had also naturally been rising during the 2017 and 2021 bull runs. At the height of the latter rally around November 2021, the BTC total transfer volume had set a high of around $740 billion. This means that, at that point, the blockchain was processing the movement of capital worth $740 billion per day. This peak is still the all-time high (ATH) for the metric.

In its latest rally, BTC has recently managed to set a brand new price ATH, and it’s still trading not far from these highs. Despite this, though, the peak in the total transfer volume observed so far is just $118 billion. This is only around 16% of the ATH value registered at the height of the 2021 bull run, while the price levels witnessed recently have been comparable to back then. What this implies is that the demand for trading on the network is much less currently than back then.

As the chart shows, when the 2021 bull run first surpassed the ATH set in the 2017 bull run, its volume attained similar levels as during the previous peak. Why, then, is the current bull run different in this pattern?

A potential factor could be the presence of the Bitcoin spot exchange-traded funds (ETFs) this time around. The spot ETFs, which found approval back in January, buy and hold BTC, and allow their users to gain indirect exposure to the Cryptocurrency in a mode that’s familiar to traditional investors.

The spot ETFs have brought significant demand into the asset, but these new investors are different from the usual holders of the Cryptocurrency who actively participate in the network.

The fresh demand through the spot ETFs is all “off-chain,” so to speak, as the ones holding their coins are the funds themselves, meaning that these new investors can’t exactly make on-chain manipulations that would end up reflecting on the transfer volume.

BTC Price

Bitcoin had recovered back above the $69,000 level yesterday, but it would appear that the asset has already lost these gains as it’s now trading around $66,600 again.

Looks like the value of the asset has been overall moving sideways in the last few days | Source: BTCUSD on TradingView

Featured image from iStock.com, CryptoQuant.com, chart from TradingView.com

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

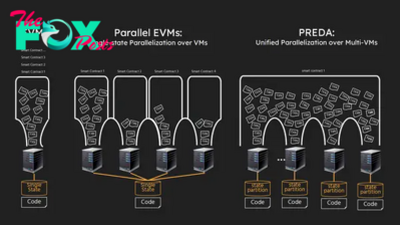

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network