Cryptocurrency

Australian Watchgod After Crypto Firms For $104M Collapse

According to local reports, the Australian Securities and Investment Commission (ASIC) has started legal procedures against two crypto companies and their directors for operating unlicensed in the country. Allegedly, the companies participated in an elaborate scheme that resulted in the loss of AU$ 160 million, worth $104 million, from investors.

ASIC After Unlicensed Mining Companies

The Australian regulator commenced civil procedures against the NGS Group companies and their directors, Brett Mendham, Ryan brown, and Mark Ten Caten. The NGS Blockchain crypto mining companies include NGS Crypto, NGS Digital, and NGS Group.

ASIC alleges that the NGS companies targeted Australian investors to acquire blockchain mining packages with a fixed-rate return. The regulator also accuses the companies of allegedly encouraging investors to use self-managed super funds (SMSFs) and convert the money into crypto.

According to the NGS Crypto website, the company was formed in 2018 as a blockchain firm. As part of the NGS Group, the firm “aims to help members generate consistent returns.”

The Australian regulator stated in their press release that these financial services are being provided without the proper licensing. Due to this, ASIC is seeking “interim and final injunctions against the NGS Companies.”

ASIC Chair Joe Longo urged Australian users to consider the risks involving self-managing the SMSFs before using the funds to invest in crypto-related investment products like those offered by the NGS Group.

Moreover, ASIC’s Chair warned the industry about the regulator’s standard to scrutinize crypto products:

These proceedings should also send a message to the crypto industry that products will continue to be scrutinised by ASIC to ensure they comply with regulatory obligations in order to protect consumers.

The Australian regulator applied to the Federal Court to designate liquidators responsible for the companies’ digital assets. The request was made because the regulator believed the investor’s assets were “at risk of dissipation.”

On Wednesday, the court approved the request and prevented Mendham from leaving the country. The preliminary investigations revealed that over 450 Australians invested AU$62 million, approximately $41 million, through the NGS Companies.

Crypto Funds Busted For Irregularities

Similarly, over 100 investors are owed over AUD$ 100 million, around $64.6 million, by the now-collapsing DCA Capital, Digital Commodity Assets, and the Digital Commodity Assets Fund.

Recently, investigations started after investors denounced the crypto funds operated by Ash Balanian, an alleged former NASA mission scientist. As a result, liquidators were appointed to the three companies managed by Balanian.

Per the report, the fund was geared at wealthy investors, requiring a minimum deposit of AU$ 50,000. Investors discovered irregularities in the fund’s management, which resulted in the authorities’ involvement.

Numerous investors were concerned as they considered that the funds failed to hold the required licenses and “breached managed investment scheme requirements.”

On Wednesday, the Australian Federal Court ordered the freezing of Balanian’s assets, worth AU$55 million, and the crypto fund manager to hand over his passport.

Crypto total market cap sitting at $2.55 trillion. Source: TOTAL on Tradingview

Featured Image from Unsplash.com, Chart from TradingView.com

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

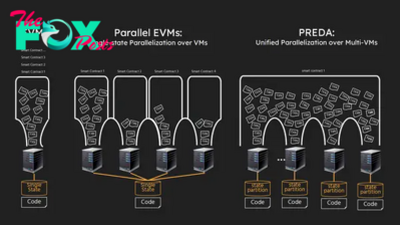

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network