Business

UBS fined nearly $400 million related to Credit Suisse's relationship with failed fund Archegos

NEW YORK -- Swiss banking giant UBS will pay nearly $400 million in fines to U.S., Swiss and U.K. banking authorities for the management failures of Credit Suisse, which UBS bought in June, related to how Credit Suisse handled its relationship with collapsed hedge fund Archegos Capital Management.

Archegos failed in 2021, costing Wall Street banks billions of dollars in losses, and Credit Suisse took the brunt of the losses. The Swiss bank took more than $5 billion in losses from Archegos' failure, which over a period of two years, ultimately led to the fire sale of Credit Suisse to UBS in June.

Credit Suisse management was found to give Archegos special treatment through its prime brokerage division, which caused the bank to take on undue risk when Archegos purchased a highly concentrated position in ViacomCBS. The firm's manager, Bill Hwang, is scheduled to face fraud charges for the collapse of Archegos in October.

Credit Suisse failed to “adequately manage the risk posed by Archegos despite repeated warnings,” the Federal Reserve said in a statement on Monday. The announcement was made by the Fed alongside the Bank of England and the Swiss Financial Market Supervisory Authority.

-

Business1h ago

Business1h agoWelsh sauce firm launches two new merchandise in partnership with Feast

-

Business3h ago

Business3h agoB2Prime Acquires a Security Dealer License in Seychelles, Expanding Global Operations

-

Business11h ago

Business11h agoA Call for Embracing AI—But With a ‘Human Touch’

-

Business18h ago

Business18h agoWhat is New at the Old Groovy Blueberry Location in New Paltz?

-

Business18h ago

Business18h agoBlaze Ignites Inside LaGrangeville, New York Car Wash

-

Business1d ago

Business1d agoUS long-term care costs are sky-high, but Washington state’s new way to help pay for them could be nixed

-

Business1d ago

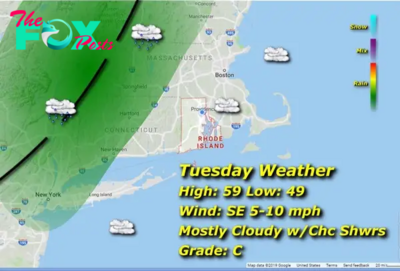

Business1d agoRhode Island Weather for April 30, 2024 – John Donnelly, meteorologist

-

Business1d ago

Business1d agoJoe Andruzzi Foundation launches UniCORN: Comprehensive New England cancer resources