Cryptocurrency

Pac Finance Sudden Parameter Change Sparks $24 Million Liquidation

Pac Finance, a lending app on Blast, has had its users report a $24 million liquidation on April 11 due to a sudden change in parameters by the developer wallet.

Mass liquidations are common for leveraged traders who borrow crypto, but they often occur due to fluctuations in the market, not protocol parameter changes.

Pac Finance LTV Change Leads to Liquidation

Pac Finance is a platform where crypto holders can earn interest by lending their assets. The app implements a loan-to-value ratio (LTV), which limits borrowers to loans equivalent to a certain percentage of their collateral to ensure repayment. Typically, the development team announces changes to the LTV beforehand.

However, on April 11 at 1:06 am UTC, according to Blast network’s blockchain data, a developer wallet changed the LTV for Renzo Restaked Ether (ezETH) to 60% without prior announcement. The sudden adjustment in LTV parameters has sparked concerns within the community following a $24 million liquidation just seconds after the update.

Developer kydo.eth from EigenLabs initially brought light to the information, prompting Pac Finance users to voice their grievances and demand explanations on the protocol’s official Discord server.

We should be grateful that the incident was limited to only a 26m liquidation 🙏

Please, LRT protocols, discourage your users from participating in these protocols⛔️

So what happened?

$26m got liquidated on @pac_finance , a lending protocol on blast.

An EOA wallet (0xae),… https://t.co/76v0tekNmr

— kydo.eth/acc 🦇🔊 (@0xkydo) April 11, 2024

In response, the team’s Discord moderator, Bountydreams, stated they are attempting to contact the team for clarification. However, no response has been received as of writing these lines.

Protocol Change Raises Concerns Over Security Issues

According to smart contract developer Roffet.eth, the parameter change led to the liquidation of many ezETH leveraging farmers since they now violated the protocol’s collateral rules. Roffet criticized the change as “arbitrary,” as it allegedly occurred without warning.

Parsec Finance founder Will Sheehan also condemned the change, noting that it happened without warning. Sheehan estimated that borrowers incurred losses of approximately $24 million in collateral, as their assets were automatically sold off to settle their loans due to the protocol change.

Liquidation threshold was updated, seemingly without warning to trigger these liquidations, 2 blocks later $24m liquidated, h/t to @roffett_eth https://t.co/KLXv5o1Jk9 pic.twitter.com/QXzlFpwKrR

— Will Sheehan (@wilburforce_) April 11, 2024

The incident on Blast adds to a series of security issues within the platform. In early March, Blast’s lending agreement Orbit Lending faced criticism from Key Opinion Leaders (KOLs) for discrepancies in its liquidation threshold. Although the agreement stated an 83% liquidation threshold, it was reported that liquidation occurred at 80%. However, the project later compensated affected users.

In addition, Blast’s ecological project Munchables suffered an attack recently, leading to suspicions of a problem with the locking contract and resulting in the theft of 17,400 ETH (valued at approximately $62.3 million). SomaXBT revealed that Munchables had previously engaged an unknown security team, EntersoftTeam, to issue an audit report to reduce audit fees.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

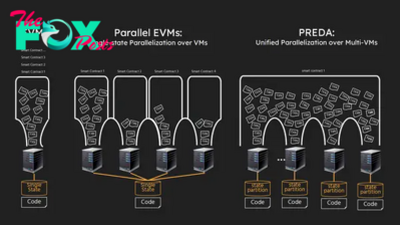

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network