Business

New knowledge reveals the preferred funding strategies for entrepreneurs in 2024

Funds are sometimes a significant supply of stress for enterprise house owners. In keeping with a current SME insights report by Dojo, a card fee supplier, 30% of companies determine monetary stress as their greatest problem for 2024.

Moreover, 1 in 2 of the companies surveyed are coping with overdue and late funds, whereas solely 2% haven’t applied or thought of implementing any cost-cutting measures.

Companies often require extra capital to fund enlargement initiatives and day-to-day operations, up to now month alone, 111,000 Google searches have been made all over the world for “enterprise loans”[1]. The necessity to borrow cash doesn’t at all times signify monetary battle; it may also be a strategic transfer to assist progress.

The examine from Dojo surveyed 1,001 enterprise founders and decision-makers to find the place they’re sourcing funds to assist their companies and the way a lot cash they’re borrowing.

SME FOUNDERS BORROWED OVER 74K FOR THEIR BUSINESS

|

Rank |

Supply of funds |

% of founders who borrowed extra funds |

|

1 |

Personal mortgage |

35% |

|

2 |

Personal investor |

32% |

|

3 |

Inheritance |

29% |

|

4 |

Private bank card |

27% |

|

5 |

Associates |

27% |

|

6 |

Authorities assist (grant/mortgage scheme) |

27% |

|

7 |

Crowdfunding |

25% |

|

8 |

Household |

25% |

The analysis from Dojo discovered that the commonest type of borrowing for SMEs is a personal mortgage, one thing which over a 3rd of founders have carried out (35%). Inheritance is the third most typical supply of funds and is most typical inside the healthcare sector (43%).

Extra founders went to buddies (27%) over household (25%) to borrow cash for his or her enterprise. Male entrepreneurs (29%) are 6% extra more likely to flip to buddies for funding than ladies (23%).

Authorities grants are probably the most utilised in Scotland, the place 45% of enterprise house owners have accessed this type of funding. In keeping with the survey, they’re least utilised within the southwest of England, the place simply 17% of them are used.

SMEs HAVE BORROWED £87,713 FOR THEIR BUSINESS ON AVERAGE

|

Enterprise turnover |

Avg. cash borrowed for his or her enterprise (£) |

|

Underneath £100,000 |

£33,867 |

|

£100,000 – £999,999 |

£58,069 |

|

£1 million – £9.99 million |

£87,680 |

|

£10 million – £49.99 million |

£84,408 |

|

£50 million – £99.99 million |

£90,665 |

|

£100 million – £499.99 million |

£94,307 |

|

£500 million or over |

£104,916 |

SMEs WHO TURNOVER £100K A YEAR HAVE BORROWED OVER £33K ON AVERAGE FOR THEIR BUSINESS

For SMEs that turnover £100K, the typical quantity borrowed for his or her enterprise was £33,867 with enterprise house owners more than likely going to their household (33%) or utilizing private bank cards (33%) to entry these funds.

SMEs WHO TURNOVER £50-99.99 MILLION A YEAR HAVE BORROWED OVER £90K ON AVERAGE FOR THEIR BUSINESS

Enterprise house owners that turnover £50-99.99 million borrowed over £90,000 for his or her enterprise, with the commonest supply of borrowing the funds being a personal mortgage (37%) adopted by non-public traders (36%) and buddies (29%).

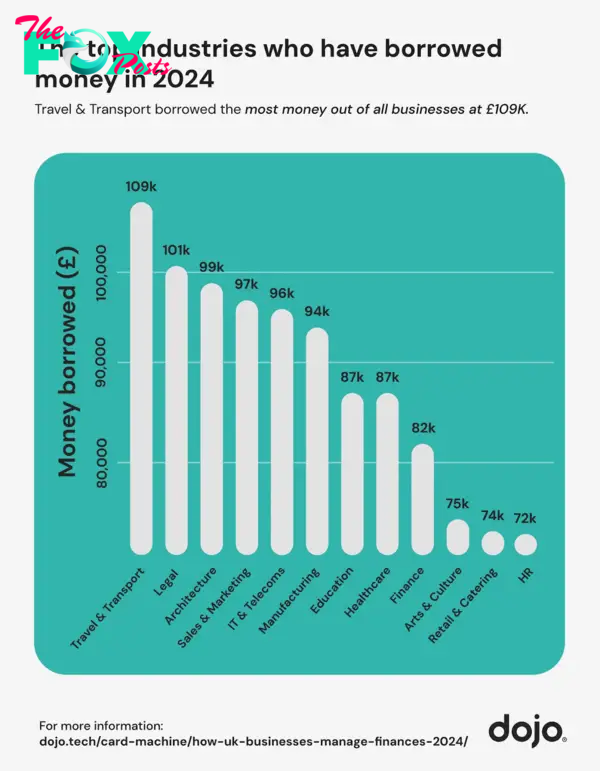

Which industries have borrowed probably the most cash in 2024?

The info discovered that on common, companies borrowed £87,713. Journey & Transport is the Business which has borrowed probably the most cash (£109k), together with Authorized who borrowed on common £101k; the one industries to have borrowed over £100k based on the survey.

HR is the Business borrowing the least amount of cash to assist operations, at £72k.

-

Business9h ago

Business9h agoNew Information: These HV Big Lots Are Now Staying Open

-

Business9h ago

Business9h agoBrush Fire Rages On Near Butternut In Great Barrington, MA

-

Business20h ago

Business20h agoU.S. Antitrust Regulators Seek to Break Up Google, Force Sale of Chrome Browser

-

Business20h ago

Business20h agoSuccessful White Men Alone Can’t Create America’s Economic Future

-

Business1d ago

Business1d agoThe Rise of Silent Services

-

Business1d ago

Business1d agoTim Latimer

-

Business2d ago

Business2d agoCarbon offsets can help bring energy efficiency to low-income Americans − our Nashville data shows it could be a win for everyone

-

Business2d ago

Business2d agoWorkplace diversity training programs are everywhere, but their effectiveness varies widely