Business

5 Myths Critics Get Wrong About Bob Iger’s Performance at Disney

As Disney’s closely watched proxy fight barrels toward the finish line with shareholders casting their votes on April 3, critics of CEO Bob Iger have launched a fuselage of attacks, criticizing Iger’s track record and his plans for turning around Disney. But amidst widespread interest from non-Business audiences, these criticisms often drown out the facts and fail to see the whole story before them.

Here are five persistent but false myths about Iger’s track record and plans for resurrecting Disney, debunked.

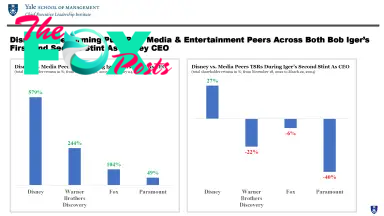

Myth: Disney stock has languished under Bob Iger’s leadership

The facts clearly show that Disney stock has significantly outperformed virtually all its pure play media and Entertainment peers during both of Iger’s stints as CEO. Disney’s 579% total shareholder returns during Iger’s first term as CEO, from 2005 to 2020, far outpaced that of key rivals Warner Brothers’ 244%, Fox’s 104%, and Paramount’s 49% during that same timeframe. And since Iger returned for his second stint as CEO in November 2022, Disney’s 27% total shareholder returns have far outpaced all its major media rivals who are in the red, with Warner Brothers Discovery’s -22%, Fox’s -6%, and Paramount’s -40% returns. No media and Entertainment peer CEO can boast of such consistent outperformance across two decades.

Disney critics point out that the company’s stock has fallen about 40% from its peak levels of nearly $200 in 2021, ignoring the fact that Bob Chapek, not Iger, was the CEO in 2021. It was Chapek who oversaw the collapse of Disney stock from $200 to $85 when he was removed in November 2022. Furthermore, Disney critics point out that Disney stock has underperformed big tech platform companies such as Apple, Amazon, Alphabet, Meta, and Netflix, but they disregard the fact that much of these companies’ value derives from their non-media Businesses and that Disney has not, and will never be, a pure play big tech company.

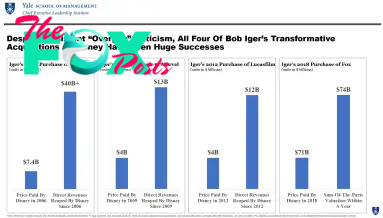

Myth: Bob Iger overpaid in major Disney acquisitions

Critics protest that Iger overpays every time a deal is struck and insist that his failed M&A track record is a reason to depose Iger as CEO. But not only is there zero financial evidence to suggest this is true, a careful analysis of the facts suggest Iger’s deals and capital allocation decisions have been rewarded many times over. Consider the payoff from each of his four big deals:

In his first big deal after taking over as CEO, Iger purchased Pixar for $7.4 billion dollars in May 2006. Although media analysts pounced, declaring “Investors, Beware: Disney is Paying Too Much for Pixar,” Disney has reaped over $40 billion in direct revenues from Pixar, not even counting derivative revenue streams such as park attractions and synergies with other Disney franchises. Following this up, three years later in December 2009, Iger purchased Marvel for $4 billion sparking the same cries that Disney overpaid. But in the time since, Marvel has reaped over $13 billion in direct revenues for Disney, again excluding derivative revenue streams and synergies which may amount to many billions more. Iger then made his third deal in December 2012 when he purchased Lucasfilm for $4 billion, with the same “overpay” criticisms abounding. In the time since, Disney has reaped approximately $12 billion in direct revenues from the Star Wars franchise.

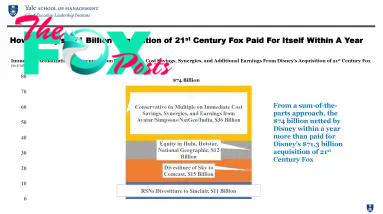

For his fourth deal, and perhaps the most controversial today, Iger purchased 21st Century Fox from Rupert Murdoch for $71 billion in 2018. Although critics continue to argue Iger overpaid, and while it is still early, this critique does not stack up to basic math. The deal cost Disney significantly less than $71 billion, and closer to $45 billion when all was said and done, since Disney immediately divested several assets at their peak valuation, including selling the regional sports network to Sinclar for $11 billion; selling Sky to Comcast for $15 billion; selling 50% of A&E Networks to Hearst; and selling TeleColombia to Paramount. Disney picked up several key assets in the deal, including a 30% stake in Hulu; a 73% stake in National Geographic Partners, and a Star India/Hotstar stake, all of which are worth $12 billion. If one puts a highly conservative 6x multiple on $6 billion in immediate earnings, cost cuts, and synergies, including $2 billion from the Avatar movie alone, then we believe the Fox deal paid for itself within the first year.

Myth: Bob Iger has lost his magic touch on movie making

Critics point to the fact Disney has lost money on its last five movies—but each of those money-losing films were either greenlit or largely produced under the watch of predecessor Bob Chapek, who had little creative experience and whose tendency to alienate creative talent was well documented. In fact, during Chapek’s entire tenure as CEO, not a single Disney movie released under his watch crossed $1 billion in gross box office revenues, with high-budget misses such as Black Widow, Encanto, Thor: Love and Thunder, Pinocchio, and Black Panther: Wakanda Forever underperforming at the box office. In contrast, Iger had seven films cross $1 billion in box office profits in his last full year as CEO alone in 2019, and Iger has produced 8 of the top 10 and 13 of the top 20 biggest box office openings of all time. Bob Iger has acknowledged that Disney’s creative engine “lost its way”, and is now prioritizing quality over quantity after clearing the cluttered content pipeline, canceling at least a dozen projects greenlit by Chapek.

Myth: Bob Iger is failing to turn around Disney

Although Disney stock is up 27% since Iger returned in Nov. 2022, and is the top performing stock in the Dow Jones Index this year, critics continue to suggest Iger is not doing enough. In fact, Iger’s performance during his second run as CEO already far exceeds those of peers who returned to the CEO job after a successful first run. Starbucks stock was down nearly 50% a year after Howard Schultz returned to Starbucks in 2008, but after three years had returned 63%. Similarly, after Michael Dell returned to Dell in 2007, the stock fell 17.3% a year into his tenure before multiplying by several times over the next decade. Even Apple, under founder Steve Jobs, took three years to pull off its stunning stock rebound of 403% after his 1997 return as CEO. (Iger served on that board under Jobs.)

Iger’s plan for fixing Disney is well underway and paying dividends already. After a year spent fixing inherited issues, Disney’s flywheel is now firing on all cylinders, with free cash flow iNFLecting eightfold from $1 billion in 2022 before Iger returned, to well over $8 billion expected this year.

Myth: The Disney board is unduly deferential to Bob Iger and dropping the ball on leadership succession

Disney’s board is one of the most impressive boards in modern corporate America, with strong, independent, qualified CEO peers of Iger including GM CEO Mary Barra; Oracle CEO Safra Catz; Morgan Stanley Chair James Gorman; Former Nike CEO Mark Parker; and Lululemon CEO Calvin McDonald; not to mention top executives from Cisco, Meta, Sky, CVS, and JPMorgan—all of whom are independent directors and do not have any personal ties to Iger.

Furthermore, with a new special subcommittee of the Board focused on leadership succession led by Mark Parker and James Gorman, both of whom oversaw seamless succession processes at Nike and Morgan Stanley respectively, Iger continues to cultivate a strong team of key deputies including Disney Entertainment Co-Chairs Dana Walden and Alan Bergman; Parks Chair Josh D’Amaro, and ESPN Chair Jimmy Pitaro, who have driven revenue growth and $8 billion in cost cuts after Iger restored authority to these key creative leaders.

Plus, Iger surprised the media world by attracting back to the team two past CEO candidates, Tom Staggs, the former CEO of Disney Parks and Resorts as well as former Chief Operating Officer of Disney and Kevin Mayer who led Walt Disney Direct to Consumer and International Businesses. Finally, the consumer products and financial worlds were impressed when highly respected PepsiCo CFO Hugh Johnston left to join Iger as well.

Read More: Bob Iger Outsmarting Ron DeSantis Is a Master Class in Taking on Bullies

As we’ve shown, these five myths about Iger’s track record and plans for resurrecting Disney are not grounded in factual reality. While it is true that some media monarchs cling to power past their peak, clearly, the facts suggest Iger deserves to complete his second decade at the helm of Disney. But above all, under Iger’s impressive stewardship, his plans for turning around Disney are already reaping massive rewards.

As film critic Roger Ebert once said, “no good movie is too long and no bad movie is short enough!” Despite the length of Iger’s career, perhaps it is still not long enough. The drama surrounding Disney has become a triumphant saga under Iger’s leadership, which should play on.

-

Business1d ago

Business1d agoUS House passes measure that could punish nonprofits Treasury Department decides are ‘terrorist’

-

Business1d ago

Business1d agoFast fashion may seem cheap, but it’s taking a costly toll on the planet − and on millions of young customers

-

Business2d ago

Business2d agoNew Information: These HV Big Lots Are Now Staying Open

-

Business2d ago

Business2d agoBrush Fire Rages On Near Butternut In Great Barrington, MA

-

Business4d ago

Business4d agoCarbon offsets can help bring energy efficiency to low-income Americans − our Nashville data shows it could be a win for everyone

-

Business4d ago

Business4d agoWorkplace diversity training programs are everywhere, but their effectiveness varies widely

-

Business4d ago

Business4d agoFirm bosses urged to make use of Welsh language to revitalise rural economic system

-

Business5d ago

Business5d agoDonor-advised funds are drawing a lot of assets besides cash – taking a bigger bite out of tax revenue than other kinds of charitable giving