Health

Individual health insurance rates in Colorado could see a below-average increase in 2025

Health insurance premiums for people who buy coverage on their own in Colorado look set to increase 5.5% overall next year, slightly below average for recent years, according to preliminary numbers released Wednesday.

Colorado Option plans — which are designed by the state with the intention of providing better benefits for lower prices — look likely to increase by slightly less, 4.2%.

The figures are part of preliminary filings that health insurers sent to state regulators for their approval. The state Division of Insurance reviews and typically knocks proposed rate increases back somewhat before releasing finalized rates in the fall.

Now, before your eyes glaze over, here’s why this matters.

These rate increases apply to people who buy health insurance without help from an employer — and there’s a good chance that’s not you. Only about 5% of Coloradans buy private health insurance on their own, according to the latest Colorado Health Access Survey. Collectively, they make up what is known as the individual market.

But, while this market represents just a small slice of insurance coverage in the state, it has historically held outsized political significance, making its premium rate fluctuations something like a Dow Jones Industrial Average for tracking the well-being of the health insurance system as a whole.

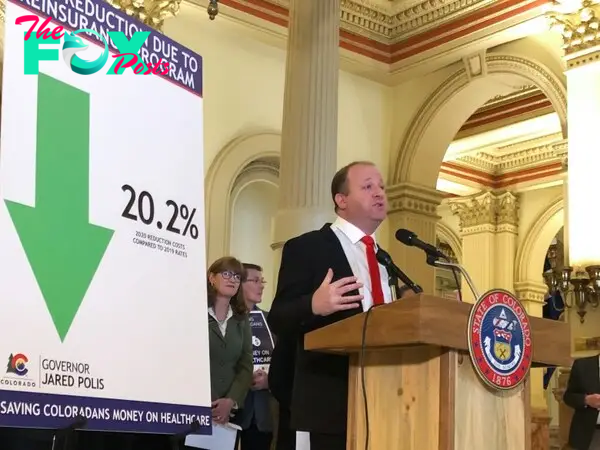

This political significance is partly because state and federal regulators can have the most influence here — for instance, the individual market is where much of the heavy lifting of the Affordable Care Act, from premium subsidies to insurance exchanges, occurs. State policymakers in Colorado have also targeted the individual market for reforms. Gov. Jared Polis’ often-touted work to save Coloradans money on health care focuses heavily on the individual market.

And that is why the annual announcement of next-year rates for the individual market comes with so much fanfare from the Polis administration. It’s essentially an annual test of whether their health policies are working.

“Colorado is leading the nation in saving people money on health care,” Polis said Wednesday in a statement. “What we are doing in Colorado is starting to work, and … we need to continue pushing hard to save people money on health care.”

☀️ READ MORE

Colorado identifies three new human cases of bird flu and more people are symptomatic

Colorado dropped people from Medicaid at a rate comparable to red states, alarming advocates for the poor

Nearly 1.8 million chickens will be culled in the latest bird flu outbreak at a Colorado poultry farm

Polis’ health insurance initiatives have two big pillars.

One is a system called reinsurance, in which the state uses a fee from insurers and federal dollars to build a fund that can help insurers pay their highest-cost claims. That allows the insurers to reduce premium prices for everybody.

In its announcement Wednesday, the Polis administration estimated that premiums would have increased 23% for 2025 had reinsurance not been in place — meaning the program will create an estimated $477 million in savings for people next year. Since the beginning of the program, the state estimates consumers will by the end of 2025 have saved more than $2 billion.

“When I take a step back and think about the fact that we will have saved Coloradans $2 billion, that’s pretty amazing,” Michael Conway, the state’s commissioner of insurance, said in an interview.

The second major Polis administration program is the Colorado Option, which created a state-designed insurance plan that private insurers are required to sell. To keep prices of the Colorado Option low, state law gives Conway a limited ability to dictate hospital contract prices with insurers if the insurers’ Colorado Option premiums don’t meet certain targets.

Conway has never used that authority, but he said that’s because hospitals and insurers are negotiating lower prices on their own.

“We’re bending the cost curve with the Colorado Option,” Conway said.

About a third of insurance plans purchased for this year through the state’s insurance exchange were Colorado Option plans, up significantly from the 13% for 2023, the program’s first year.

Conway said the Colorado Option’s proposed lower-than-average rate increases for 2025 are a testament to its success. Non-Colorado Option plans look set for a 6.2% increase.

Overall, since the implementation of the Affordable Care Act, Colorado’s individual insurance market has seen average annual premium increases of about 6.9%. While the big fluctuations have evened out in more recent years, the average annual increase since 2022 is about the same.

-

Health3h ago

Health3h agoThe Surprising Benefits of Talking Out Loud to Yourself

-

Health5h ago

Health5h agoDoctor’s bills often come with sticker shock for patients − but health insurance could be reinvented to provide costs upfront

-

Health20h ago

Health20h agoWhat an HPV Diagnosis Really Means

-

Health1d ago

Health1d agoThere’s an E. Coli Outbreak in Organic Carrots

-

Health1d ago

Health1d agoCOVID-19’s Surprising Effect on Cancer

-

Health2d ago

Health2d agoWhat to Know About How Lupus Affects Weight

-

Health5d ago

Health5d agoPeople Aren’t Sure About Having Kids. She Helps Them Decide

-

Health5d ago

Health5d agoFYI: People Don’t Like When You Abbreviate Texts