Politics

Biden Announces New Student Loan Forgiveness Plan Details. Here’s What to Know

The Biden Administration will announce some new details of its proposed student loan forgiveness plan Monday, which if implemented, could bring forgiveness for a combined 30 million people this fall.

"These historic steps reflect President Biden’s determination that we cannot allow student debt to leave students worse off than before they went to college,” said U.S. Under Secretary of Education James Kvaal. “The President directed us to complete these programs as quickly as possible, and we are going to do just that.”

The Administration is currently pursuing debt relief through the negotiated rulemaking process under the Higher Education Act. Last June, the Supreme Court rejected Biden’s student loan forgiveness plan that would have erased a whopping $400 million in student loan debt for 42 million people. This proposed plan could still face legal challenges.

The new plan, however, would eliminate accrued interest on loans for 23 million borrowers, cancel the full amount of student loan debt of some 4 million others, and give another 10 million borrowers at least $5,000 or more in relief.

“President Biden will use every tool available to cancel student loan debt for as many borrowers as possible, no matter how many times Republican elected officials try to stand in his way,” White House press secretary Karine Jean-Pierre said during a press call on Sunday.

President Biden Traveled to Madison, Wis. to share the news.

The Administration's previous efforts for forgiveness included making changes to the Public Service Loan Forgiveness program (PSLF) and income-driven repayment plans that have led to $146 billion in loan forgiveness.

Read more: Unable to Pay Your Student Loans? It Won’t Affect Your Taxes Yet

Negotiators first gathered last October to start the rule-making process, which goes through multiple rounds of comment and discussion before they are finalized. The final proposed debt relief rules will be released for public comment in the next few months, after which consensus must be reached among negotiators to finalize the new regulatory language.

Here’s what to know about the new student loan forgiveness plan.

Cancel accrued and capitalized interest

More than 25 million Americans owe more than what they originally borrowed because of interest rates on their student loans.

The Biden Administration plans on addressing this by canceling $20,000 in unpaid interest on a borrower’s balance regardless of their income. Borrowers in the Saving on a Valuable Education, or SAVE plan—single borrowers who make $120,000 or less—would be eligible for broader forgiveness. That means that the “entire amount their balance has grown since entering repayment” would be canceled, according to a fact sheet provided by the White House.

Read more: How to Know If You’re Eligible for Biden’s SAVE Student Loan Repayment Plan

If the plan is approved, borrowers would not need to apply for relief to see changes on their account.

Automatic debt cancellation for borrowers eligible for relief

Under the proposed plan, the Administration would automatically forgive debt for borrowers who are eligible for cancellation, but have not enrolled in programs like SAVE, or PSLF. The action would cancel debt for some 2 million Americans, the Administration said.

Cancel debt for borrowers who began paying two decades ago

The Administration would cancel student loan debt for borrowers with undergraduate debt who entered repayment 20 or more years ago. Americans with graduate school debt would have to have entered repayment 25 or more years ago to be eligible for forgiveness.

Borrowers do not need to be enrolled in an income-driven repayment plan to be eligible for this type of forgiveness.

Read more: Your Company Could Match Your Student Loan Payments to Your 401(k). Here’s How That Will Work

Cancel debt for borrowers who are facing hardship or were enrolled in low-financial-value programs

The Administration says it will include a plan to provide relief for borrowers who are at high risk of default, or burdened by medical expenses or childcare, as part of its plan.

It will also provide relief for those who went to colleges or universities that did not provide students with “sufficient financial value.”

-

Politics18m ago

Politics18m agoBusiness Beat: Abe Cohen new VP of Business Development for RI, Marquis Health Consulting

-

Politics18m ago

Politics18m agoAdvocates, providers on new Nursing Home mandates – Herb Weiss

-

Politics1d ago

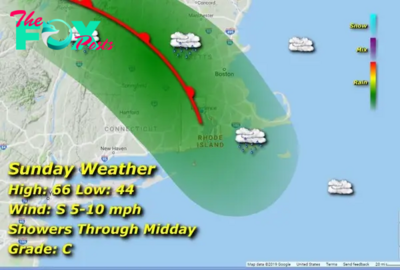

Politics1d agoRhode Island Weather for April 28, 2024 – John Donnelly

-

Politics1d ago

Politics1d agoThe Promised Land: a short story by Michael Fine

-

Politics2d ago

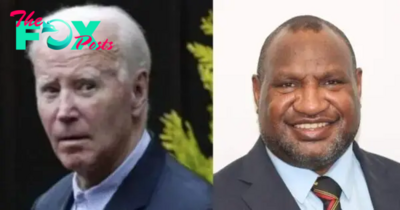

Politics2d agoPresident Of Papua New Guinea Tells President Joe Biden: Our Nation Doesn't Deserve Being Labeled Cannibals

-

Politics2d ago

Politics2d agoTrump trial reveals details about how the former president thinks about, and exploits, the media

-

Politics2d ago

Politics2d agoTrump’s immunity arguments at Supreme Court highlight dangers − while prosecutors stress larger danger of removing legal accountability

-

Politics2d ago

Politics2d agoPhiladelphia has a lot more deadly shootings than expected for a big city − and NYC is much safer, new study says