Cryptocurrency

Top 5 Cryptocurrencies to Watch if the US Federal Reserve Cuts Rates

TL;DR

- The COVID-19 pandemic led to massive economic disruptions, prompting the US government to print trillions of dollars, which resulted in high inflation.

- To counter this, the Federal Reserve raised interest rates to 5.25%- 5.50%.

- Lowering rates, on the other hand, could boost investment in numerous cryptocurrencies, with the Fed previously hinting at such a pivot.

Apart from the numerous victims and pressure on the health sector, the outbreak of the COVID-19 pandemic at the start of 2020 resulted in vacated jobs, uncertainty, isolation, financial instability, and many other setbacks. Amid those gruesome conditions, the US government printed trillions of dollars to support the crippled economy. However, the increased money supply resulted in surging inflation rates and further problems for America’s fiscal policy.

The US Federal Reserve stepped in by enforcing multiple anti-iNFLationary measures, such as raising interest rates. Between March 2022 and July 2023, the central bank lifted the benchmark 11 consecutive times, with the current level standing at 5.25%-5.50%.

The latest data shows that iNFLation in the US has cooled off, meaning the Fed might soon pivot from its aggressive regime. In the following lines, we will observe how such a measure might impact the prices of some of the leading cryptocurrencies.

Bitcoin (BTC)

The largest digital asset in terms of market capitalization may significantly benefit once the Fed lowers interest rates. The move would make money borrowing easier, which might translate into increased interest in risk-on assets such as BTC. For its part, the potential flow of fresh capital into the asset can result in a surging price.

The above is increasingly true now, following the introduction of spot Bitcoin ETFs earlier in 2024. This provides retail investors with familiar and comprehensive financial instruments to receive direct exposure to the price of BTC without having to worry about all the technicalities associated with storing it.

One famous person who believes BTC’s price will take off once the Fed pivots is Mike Novogratz. Until then, he sees the asset trading in the $55,000-$75,000 range.

Solana (SOL)

SOL experienced impressive price growth in the past year, briefly exceeding the $200 mark for the first time since December 2021.

Currently, the asset trades at around $177 (per CoinGecko’s data), a staggering 780% increase compared to the figure observed in May last year.

Solana’s ecosystem has witnessed significant activity. DefiLlama data shows that the total value locked on Solana stands at over $4.8 billion, while on-chain trading volume has been hovering around $1 billion for the past few months.

Solana is home to many retail investors because of its faster transaction times and cheap fees, creating grounds for potential increases should interest rate cuts start heating up the risk-on market.

Dogecoin (DOGE) and Dogwifhat (WIF)

Meme coins are often the Cryptocurrency industry’s most volatile asset in the case of ground-breaking events. The leading asset of that type—Dogecoin (DOGE)—and the sensation built on the Solana blockchain—dogwifhat (WIF)—will definitely be worth watching should the Fed switch its strategy.

Both assets have devoted community bases, receiving support from prominent figures and leading Cryptocurrency exchanges, and have been the subject of massive hype.

DOGE is Tesla CEO Elon Musk’s favorite digital asset. Not long ago, the EV giant officially introduced the token as a payment method. For its part, WIF received backing from BitMEX’s co-founder Arthur Hayes.

Ethereum (ETH)

Another asset worth observing in the event of a Fed pivot is the second-largest by market cap: Ethereum (ETH). Its price has previously spiked following announcements that iNFLation in the US was cooling off or disclosures that interest rates would remain untouched (instead of raised).

For example, ETH has jumped by almost 10% since May 15 – the day when the US Bureau of Labor Statistics released the latest Consumer Price Index (CPI) data. Recall that total CPI clocked in at 3.4%, which is exactly what the expectations were.

Polkadot (DOT)

This popular blockchain protocol has completed numerous updates as of late, and as such, is also worth watching in case of increased volatility. Most recently, the team behind it enabled Asynchronous Backing on the network. It is an optimization technique designed to improve the process of parachain block production and inclusion in the Relay chain (the main chain of Polkadot).

Polkadot also unveiled the Join-Accumulate Machine (JAM) Gray Paper. It is a technical upgrade whose goal is to create a more efficient, secure, and scalable blockchain environment that integrates the best aspects of both Polkadot and Ethereum technologies.

Its price has been confined within a very tight range throughout the past few months, which is usually a precursor to considerable volatility. If the Fed decides to cut rates, this volatility might kick in, triggering a considerable move in Polkadot’s price.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

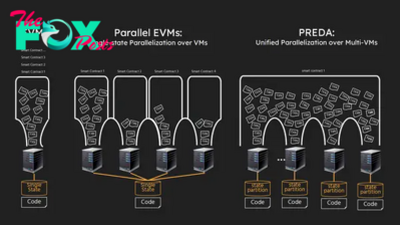

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network