Cryptocurrency

Research Firm Predicts Ethereum Explosion To $15,000 With ETFs

Michael Nadeau, founder of The DeFi Report, has published a deep dive into the implications of the approval of spot Ethereum (ETH) Exchange-Traded Funds (ETFs) on the Cryptocurrency’s price trajectory. This analysis follows on the heels of a significant regulatory nod from the US Securities and Exchange Commission (SEC), which approved the 19b-4 applications for eight leading financial entities — Grayscale, Bitwise, BlackRock, VanEck, Ark 21Shares, Invesco, Fidelity, and Franklin.

These approvals, granted under a collective omnibus order on May 23, set the stage for the final steps, which involve awaiting S-1 registrations’ sign-offs before these spot ETFs can start trading.

Why Ethereum Could Skyrocket To $15,000

The report draws upon projections by ETF experts at Bloomberg, such as James Seyffart and Eric Balchunas, suggesting that the iNFLows into Ethereum ETFs could range between 10-20% of those experienced by Bitcoin ETFs. “The logic behind these projections rests on a few key observations—currently, there is less institutional interest in ETH, and it is inherently more complex than BTC. Also, the ETH futures ETF volume is considerably less than BTC’s, ranging from 10-20%, and ETH spot trading volumes are roughly half of BTC’s,” Nadeau explains.

He added that “ETH is more difficult to understand than BTC. ETH futures ETF volume is less than BTC (10-20%). ETH spot trading volumes are less than BTC (about 50%). ETH is about 1/3 of BTC’s market cap.”

Related Reading

However, according to the researcher, the dynamics of Ethereum offer a unique perspective when compared to Bitcoin. “Ethereum validators do not incur the substantial operating expenses that Bitcoin miners do, which mitigates the structural sell pressure on the asset,” Nadeau states. This difference is critical in understanding the supply-side dynamics of Ethereum compared to Bitcoin.

Nadeau also delves into the current status of Ethereum on-chain activities. A substantial portion of Ethereum, approximately 38%, is effectively ‘soft locked’ across various mechanisms like staking contracts and DeFi applications. This scenario, as Nadeau points out, “helps reduce the available circulating supply, contributing to a decrease in ETH balances on exchanges to levels not seen since 2016—currently, this stands at less than 11% of the circulating supply.”

The concept of reflexivity in Ethereum’s market behavior also receives significant attention in Nadeau’s report. “ETH is more reflexive than BTC. This reflexivity could be expressed with price action leading onchain activity, which leads to more ETH burned, which can further drive narratives, more price action, more onchain activity, and more ETH burned,” Nadeau elaborates, suggesting a cyclic effect that could significantly amplify Ethereum’s market presence and valuation.

Related Reading

Exploring potential market scenarios, Nadeau questions the extent of rebalancing that might occur from spot Bitcoin ETF holders towards Ethereum, the attractiveness of a 50/50 BTC and ETH allocation, and the potential shift of institutional focus towards Ethereum. He hypothesizes, “If momentum hits ETH, will we see the ‘reflexivity flywheel’ kick into gear? How many institutions are on the sideline right now, having missed BTC? Will they go all in on ETH?”

In concluding his analysis, Nadeau presents a valuation framework that anticipates the Cryptocurrency market reaching a $10 trillion market cap. He states, “Given our fundamental views on ETH, we think it’s more likely that ETH will outperform Bloomberg’s projections of 10-20% of BTC’s net iNFLows. Under this scenario” and projects that “ETH could coMMAnd a market cap at cycle peak of $1.8 trillion, which would price ETH at approximately $14,984 (3.9x), assuming no change in supply.” He continues, “For reference, if Bitcoin reaches a $4 trillion market cap, that would price BTC at $202,000 (2.8x)” at cycle peak.

At press time, ETH was trading at $3,823, still around 29 % away from its 2021 all-time high.

Featured image created with DALL·E, chart from TradingView.com

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

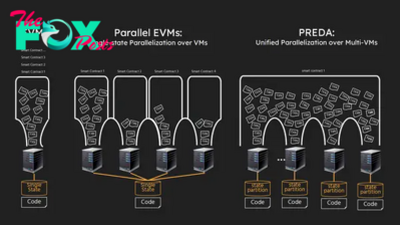

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network