Cryptocurrency

New Data Reveals Bitcoin Mining May No Longer Be Profitable

New data has revealed that Bitcoin (BTC) mining might no longer be as lucrative as it used to be. Bloomberg has reported that the profitability of Bitcoin mining is nearing a record low, not seen since the days following the collapse of FTX, posing significant challenges for those securing the network.

The data indicates that the “hashprice,” a metric that gauges the revenue a miner earns daily for each Petahash of computing power, has dipped alarmingly close to its all-time low.

This decrease is notable, considering it came after the recent Bitcoin halving event on April 20, which traditionally boosted the Cryptocurrency’s value but, this time, failed to counteract the bearish pressures from global economic uncertainties.

Notably, the term “hashprice,” coined by Luxor Technologies, reflects the ‘harsh’ realities facing miners post-Halving. The event, which occurs every four years, reduces the block reward for miners by half, intending to maintain a deflationary schedule for Bitcoin’s issuance.

Understanding Bitcoin Hashprice Dynamics

On April 20, immediately following the halving, the BItocin hash price spiked to $139, but this was short-lived. The surge was primarily due to increased transaction fees related to the Rune protocol activities on Bitcoin’s blockchain.

However, as these fees normalized and mining difficulty increased, hashprice values plummeted to $57, perilously close to the November 2022 low of $55. This value represents miners’ stark decline in profitability, forcing them to depend more on transaction fees and the potential appreciation in Bitcoin’s price.

Reducing mining profitability also signals tough times ahead, particularly for smaller mining operations.

According to Bloomberg, larger mining companies like Marathon Digital Holdings Inc. and Riot Platforms Inc. have proactively invested in extensive mining infrastructure and advanced equipment to withstand the profitability crunch.

Conversely, smaller entities might struggle to remain viable in an industry that is becoming increasingly comPetitive and capital-intensive.

Marathon Digital’s Strategic Expansion

In response to the challenging environment, Marathon Digital has raised its hash rate growth target for 2024, aiming to adapt to the new mining reward baseline of 3.125 BTC post-halving.

The company started the year with a hash rate capacity of 24.7 exahash per second and planned a 46% increase. Following strategic acquisitions and increased equipment orders, Marathon anticipates reaching a hash rate of 50 EH/s by year’s end.

Fred Thiel, Marathon’s Chairman and CEO, expressed confidence in meeting these growth targets without additional capital infusion, citing the firm’s solid liquidity position. Thiel noted:

Given the amount of capacity we have available following our recent acquisitions and the amount of hash rate we have access to through current machine orders and options, we now believe it is possible for us to double the scale of Marathon’s mining operations in 2024 and achieve 50 exahash by the end of the year.

The company’s advancements in mining Technology and efficiency also aim to reach an operational efficiency of 21 joules per terahash, further solidifying its foothold as a leader in the sector.

Featured image from Unsplash, Chart from TradingView

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

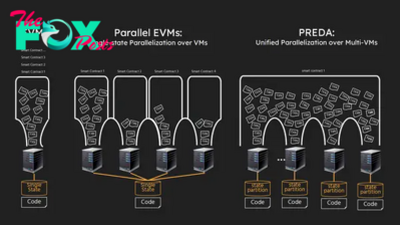

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network