Cryptocurrency

Kraken Sees Largest Bitcoin And Ethereum Outflows Since 2017, What’s going On?

Recent data shows that Kraken, one of the premier crypto exchanges in the market, has witnessed its largest outflows of Bitcoin (BTC) and Ethereum (ETH) since 2017. This signals a significant shift in digital asset holdings, which could have broad implications for the market.

Kraken’s Historic Outflows, What Is Going On?

Insights from Joao Wedson of Dominando Cripto shared on CryptoQuant’s quick-take platform highlight a startling trend at Kraken. The exchange recorded an outflow of 49,100 BTC, translating to approximately $3.33 billion.

This massive withdrawal marks the largest movement of funds from the exchange in dollar terms. Ethereum was not left behind, with roughly 572,100 ETH, valued at around $2.15 billion, also exiting the platform.

This substantial reduction has brought Kraken’s Bitcoin reserves down to levels last seen in 2018, holding about 122,300 BTC. Even more notably, Ethereum reserves have dipped below one million for the first time since early 2016.

Kraken: Largest $BTC and $ETH Outflows Since 2017!

“Kraken’s #Bitcoin reserves have dropped to the same level as in 2018, now holding 122,300 BTC. For #Ethereum, this is the first time Kraken’s reserves have fallen below 1 million units, a level not seen since early 2016.” – By… pic.twitter.com/pS4kEajpHF

— CryptoQuant.com (@cryptoquant_com) June 3, 2024

While this news may initially seem alarming, Wedson reveals that address screenings indicate the asset movements were “synchronized and rapid,” suggesting these outflows might have been the strategic repositioning of reserves by Kraken itself, or part of an institutional strategy.

Anticipating A Supply Squeeze And Price Surge

Meanwhile, the timing of these movements is crucial, coming just as the market absorbs the impact of the SEC’s recent approval of spot Ethereum ETFs.

This regulatory nod has accelerated the reduction of ETH available on centralized exchanges, heightening anticipations of a possible supply squeeze that could positively iNFLuence Ethereum’s price.

The broader context involves a significant shift away from exchanges as the primary holders of crypto assets. Market analyst Ali noted a sharp decline in Ethereum held on exchanges, with about 777,000 ETH withdrawn post-ETF approval, hinting at an evolving market dynamic where major players might be moving towards greater self-custody amidst rising institutional involvement.

Since the @SECGov approved spot #Ethereum ETFs, approximately 777,000 $ETH — valued at about $3 billion — have been withdrawn from #crypto exchanges! pic.twitter.com/EzQVC0cw27

— Ali (@ali_charts) June 2, 2024

This trend is corroborated by a broader analysis of exchange balances, which shows a continuous decrease, suggesting a strengthening preference for holding cryptocurrencies outside exchange platforms.

Such movements are traditionally viewed as bullish indicators, implying reduced sell pressure and increased long-term holding behaviors among investors.

At the time of writing, Ethereum is trading at $3,777, following a peak of $3,850 in the last 24 hours. The current trading price represents a 0.7% increase in the past day despite a nearly 5% decline over the past week. Meanwhile, Bitcoin is currently priced at $69,253, having pulled back from a 24-hour high of $70,188.

Featured image created with DALL-E, Chart from TradingView

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

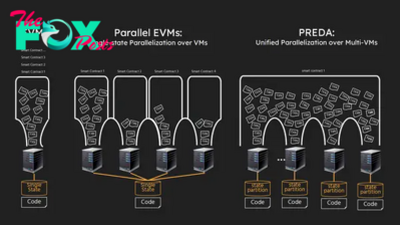

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network