Cryptocurrency

Could Bitcoin Replace Gold For National Reserves? Expert Weighs In

Gabor Gurbacs, a strategic advisor at Tether, the issuer of USDT, recently spotlighted Bitcoin’s potential in “revolutionizing” how central banks handle and secure national reserves, using India’s logistical challenges with gold as a prime example.

A Digital Solution For Traditional Gold Logistics

India’s decision to relocate a significant portion of its gold reserves from the UK back to domestic vaults has reignited discussions about the logistical challenges of physical gold. A report from the Economic Times particularly noted:

India’s central bank has moved around a 100 tonnes, or 1 lakh kilograms of gold from the United Kingdom back to its vaults in India, and intends to move more in coming months.

Leveraging this scenario, Gurbacs suggested that cryptocurrencies like Bitcoin could offer a more “seamless solution” for such national operations.

His commentary, based on a recent development where the Reserve Bank of India transported 100 tons of gold, emphasized Bitcoin’s ease of transfer and storage advantages.

He proposed that in times of geopolitical tension, which complicates traditional financial operations, Bitcoin and tokenized assets like XAUT (Swiss vaulted tokenized gold) could be more adaptable alternatives for central banks looking to de-risk their gold holdings.

India’s central bank has moved around 100 tonnes gold from the United Kingdom back to its vaults in India and intends to move more in coming months.

Geopolitical tensions makes vaulting and basic financial Business in non-neutral countries difficult.https://t.co/GL2kZe2zfX

— Gabor Gurbacs (@gaborgurbacs) May 31, 2024

India’s storage of gold began in 1991, during a severe foreign exchange crisis, when it pledged portions of its gold reserves, a move that attracted substantial criticism.

After more than three decades, marking a significant shift, India has resumed purchasing gold and relocating some of its reserves from the United Kingdom. Historically, a portion of India’s gold reserves has been housed at the Bank of England in London since gaining independence.

While no one was watching, RBI has shifted 100 tonnes of its gold reserves back to India from UK. Most countries keep their gold in the vaults of the Bank of England or some such location (and pay a fee for the privilege). India will now hold most of its gold in its own vaults.…

— Sanjeev Sanyal (@sanjeevsanyal) May 31, 2024

Bitcoin As A Treasury Revolution?

Expanding on the narrative, the discussion around Bitcoin’s role goes beyond mere logistics. In a recent interview with Peter McCormack on the “What Bitcoin Did” YouTube channel, former MicroStrategy CEO Michael Saylor extolled Bitcoin as the ultimate asset for modern treasury needs, suitable for corporations, families, and individuals.

Saylor, a well-known proponent of Bitcoin, discussed the Cryptocurrency’s impact on weakening traditional fiat currencies and its “revolutionary” effect on the global financial system.

He emphasized Bitcoin’s role in redistributing power from centralized institutions back to individuals, asserting that BTC functions as a “transformative” Technology and an asset.

Saylor also articulated the principles of Bitcoin ideology, which champion individual autonomy, privacy, and freedom, underscoring the Cryptocurrency’s potential to correct systemic financial misinformation and decay.

Describing BTC as a ‘freedom virus,’ Saylor envisions it as a tool to empower global citizens by promoting financial independence and integrity.

Featured image created with DALL-E, Chart from TradingView

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

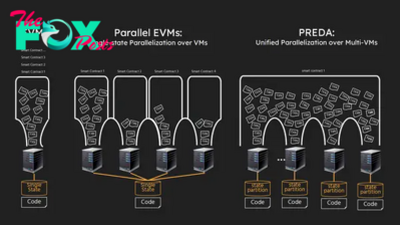

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network