Cryptocurrency

BTC Records Best Week Since March Amid US CPI Announcement and Big Names Buying Bitcoin ETFs: This Week’s Crypto Recap

A lot can change in the cryptocurrency market within the span of a week and it indeed did in the past seven days. It was just last Friday when bitcoin was struggling to remain above $60,000 after another leg down, but the landscape is quite different now.

The changes started to happen during the weekend when BTC remained above the aforementioned level and even increased slightly to around $61,000. However, the first big move came on Monday when the cryptocurrency pumped to just over $63,000.

It failed to sustain that rally and retraced hard on Tuesday amid some CoiNBAse issues and perhaps due to pressure from the upcoming US CPI announcement on Wednesday. Once that came out, though, and the reality met expectations, bitcoin started climbing rapidly.

It jumped by several grand and shot above $66,500 as the iNFLows to the ETFs accelerated as well. The asset retraced slightly yesterday to just under $65,000 but went back on the offensive today. As a result, BTC returned to over $66,000, marking its best week since the early days of March and making investors greedy again.

Speaking of a weekly scale, some of the most impressive gainers from the larger-cap alts include Solana, which skyrocketed earlier this week, and Chainlink, which tapped a multi-month peak of over $16.

Market Data

Market Cap: $2.533T | 24H Vol: $78B | BTC Dominance: 51.6%

BTC: $66,455 (+5.35%) | ETH: $3,086 (+2.1%) | BNB: $580 (-2.61%)

This Week’s Crypto Headlines You Can’t Miss

Bitcoin’s Fundamentals Remain Strong Amid Market Volatility: Bitfinex, Despite bitcoin’s retracement from the end of last week, Bitfinex highlighted in a report from Monday that all the network’s fundamentals have remained strong, even though the difficulty had declined slightly.

The Floppening: Ethereum Can’t Stop Losing Ground To Bitcoin. The graph above shows that ETH has failed to produce gains similar to those of BTC. In fact, the second-largest Cryptocurrency has declined in value a lot compared to bitcoin in the past several months, making the so-called ‘flippening’ more of a distant dream than a potential reality.

Morgan Stanley Reveals $269 Million Investment in Grayscale’s GBTC. Publicly listed US giants had to disclose their financial activities during the first quarter of the year in separate filings to the US SEC. As such, several big names, such as Morgan Stanley, outlined multi-million dollar investments in different Bitcoin ETFs.

Wisconsin State BTC Investment Could Cause Chain Reaction From Other States. One of the other notable and perhaps surprising names on the BTC bandwagon list was the State of Wisconsin Investment Board (SWIB). Its $164 million investment in Bitcoin ETFs raises the question of whether other similar entities will follow suit.

CME Group Plans Spot Bitcoin Trading Amid Rising Wall Street Demand. CME Group, a traditional finance giant that has a rich History with the Cryptocurrency industry, is reportedly looking into entering the spot Bitcoin trading market, something that the firm has avoided in the past. This could create lots of comPetition for established names like CoiNBAse and Binance.

ShibaSwap 2.0 Goes Live On Shiba Inu’s Layer 2 Blockchain. Shiba Inu’s ecosystem has been among the most active in the past year or so, and this week marked the migration of the native decentralized exchange to Shibarium in the form of ShibaSwap 2.0.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

#crypto

-

Cryptocurrency1m ago

Cryptocurrency1m agoRoblox’s “Adopt Me”: A Comprehensive Guide to Trading Values

-

Cryptocurrency1m ago

Cryptocurrency1m agoThe Rise of Cryptocurrency in Online Gambling

-

Cryptocurrency2m ago

Cryptocurrency2m agoExchanging FTM for wBTC in 2024: When Is the Right Time?

-

Cryptocurrency2m ago

Cryptocurrency2m agoHere Are The best crypto wallets for Android devices

-

Cryptocurrency5m ago

Cryptocurrency5m agoWhy Donald Trump Loves Bitcoin

-

Cryptocurrency5m ago

Cryptocurrency5m agoBEVM Visionary Builders (BVB) Program Launches a 60 Million Ecosystem Incentives Program

-

Cryptocurrency5m ago

Cryptocurrency5m agoClues To MKR’s Price Path Ahead

-

Cryptocurrency5m ago

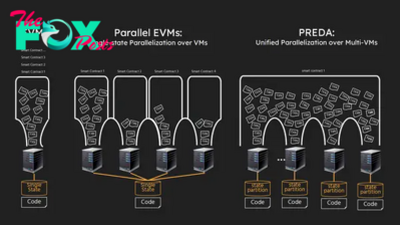

Cryptocurrency5m agoBitReXe: Enabling Parallel VMs on Bitcoin Network